Central Banking

Photo credit: Federal Reserve.

Introduction

Central Banks set some rules for banks but also prioritize the interests of private banks. But who sets rules for them? What is their impact?

Other Resources on Central Banking

Top articles: Joseph Brown, Do We Actually Need Taxes? The Fed Can Print Infinite Money... Heresy Financial, Apr 24, 2020. Brown argues that US taxes are politically important to require people to use the US dollar, since the US dollar and US treasuries are the global default currency. See also Joseph Brown, Is History Repeating Itself with a Fiat Collapse? | John Law and the Mississippi Bubble. Heresy Financial, May 5, 2020. For a historical parallel that is easily understandable. See also Joseph Brown, Dismantling Idiotic Deflation Ideas. Heresy Financial, May 7, 2020. Argues deflation is a net positive for society, especially the poor; whereas inflation generally benefits the wealthy; points out that the Federal Reserve allows private banks to continue to be highly leveraged and block runs on the banks. Joeri Schasfoort, The Monetary Financial System Visually Explained. Money & Macro, Dec 9, 2020. Presents a hierarchy of money, made of three tiers: monetary core of central bank money (including M1, M2, and M3 money, as well as reserves, that can either be created through money printing, monetary finance, or quantitative easing), a large monetary periphery of money created by private banks, and an even larger financial crust that contains all other financial instruments (such as those issued by shadow banks and money market mutual funds). Michael Cowan, The Fed Has Destroyed The Dream Of Retirement Forever. Michael Cowan, Jan 17, 2022. Michael puts together concerns about an aging population, declining government tax policy and increasing expenses, and inflation. Very helpful macroeconomic perspective.

William Greider, Secrets of the Temple: How the Federal Reserve Runs the Country. Simon & Schuster | Amazon page, 1987.

Alan Greenspan, Gold and Economic Freedom. SwiftysmithUK, Aug 14, 2011. explores how central bank inflation fuels the growth of the welfare-warfare state; contrast with Noam Chomsky, The Federal Reserve. Chomsky Philosopher, Jan 27, 2015. Chomsky takes a more moderate position on central banking but critical view of Republican strategy.

Jeremy Corbett, The Federal Reserve Bank Conspiracy Explained - Century of Enslavement . Top Documentary Films, Dec 2, 2014. a 90 minute documentary

Ben Swann, 100 Years of the Federal Reserve . Truth in Media, Dec 19, 2013.

Neil Irwin, The Federal Reserve Was Created 100 Years Ago. Here's How it Happened. Washington Post, Dec 21, 2013.

Matthew Yglesias, Ben Bernanke's Biggest Mistake . Slate, Feb 24, 2014.

Matthew O'Brien, How the Fed Let the World Blow Up in 2008 . The Atlantic, Feb 26, 2014.

Yanis Varoufakis, Ancient Greece and the Political Nature of Money. Athena Vibrating, Nov 7, 2014. links debt to regimes hiring labor extracting resources. food. from land, thus creating money

Paul Langley, Liquidity Lost: The Governance of the Global Financial Crisis. Oxford University Press | Amazon page, 2015. This book is invaluable as a record of how Anglo-American bankers and politicians defined the financial crisis of 2008. They defined it in terms of liquidity with regards to themselves. to which the answer was "quantitative easing", but in terms of risk of default with regards to Greece, to which the answer was "austerity". This suggests that some people get to define problems and solutions for political reasons, where the labeling of the crisis already prescribed a solution, and how the labeling favored Anglo-Americans and crippled everyone else; this is an excellent study in cultural anthropology; see also book review by Sarah Hall. Journal of Cultural Economy, Jul 2015. and Journal of Cultural Economy.

Nomi Prins, All the Presidents' Bankers: The Hidden Alliances that Drive American Power. Bold Type Books | Amazon page, Mar 24, 2015.

Olle Kullberg, How Money from the Fed Ends Up in China . AuZterity blog, Apr 17, 2015.

Adam Davidson, You're Not Supposed to Understand the Federal Reserve . New York Times, Oct 20, 2015.

Lawrence Jacobs and Desmond King, Fed Power: How Finance Wins. Oxford University Press | Amazon page, Apr 2016.

Ted Mellnik, Darla Cameron, Denise Lu, Emily Badger and Kat Downs, American's Great Housing Divide: Are You a Winner or a Loser? Washington Post, Apr 28, 2016.

Yanis Varoufakis, And the Weak Suffer What They Must? Talks at Google, Apr 29, 2016.

John Coumarianos, The Fed Has Fueled Inflation - And It's Helping the Rich . MarketWatch, May 23, 2016.

Yanis Varoufakis and Noam Chomsky . NYPL, Apr 26, 2016. on Greek debt, economic theory, the EU

Anonymous News, Politician Exposes Central Bank Scam . Anonews, Jul 18, 2016.

Gary Gordon, Quantitative Failure: Is The Faith In Central Bank Omnipotence Fading? . Seeking Alpha, Aug 19, 2016.

Chris Arnold, Federal Reserve Chair Throws Cold Water On Trump's Economic Plan . NPR, Nov 17, 2016.

Stephen G. Cecchetti and Kermit L. Schoenholtz, Why a Gold Standard Is a Very Bad Idea. Money and Banking, Dec 19, 2016.

Matt Stoller, Federal Reserve Bankers Mocked Unemployed Americans Behind Closed Doors . The Intercept, Jan 27, 2017.

Alice Salles, Saudi Arabia, Yemen, and What You’re Not Being Told About Trump’s Travel Ban . Anonymous, Feb 1, 2017. Nixon's petrodollar deal with Saudi Arabia

Judy Shelton, Currency Manipulation Is a Real Problem . Wall Street Journal, Feb 13, 2017. What’s the point of free-trade deals if governments can wipe out the benefits with monetary maneuvers?

Sharmini Peries and Michael Hudson, Finance as Warfare: The IMF Lent to Greece Knowing It Could Never Pay Back Debt . Counter Punch, Feb 21, 2017.

Cato Institute, Central Banks and Financial Turmoil . Cato Institute, Spr-Sum 2017.

Jörg Guido Hülsmann, The Cultural Consequences of the Federal Reserve . Mises Institute, Jun 1, 2017. inflation incentivizes indebtedness

Helena Smith, Greek Debt Crisis: ‘People Can’t See Any Light at the End of Any Tunnel’ . The Guardian, Jul 30, 2017. ; see also Michelle Jamrisko & Catarina Saraiva, These Are the World’s Most Miserable Economies. Bloomberg, Feb 14, 2018. and Aristides Hatzis, Greek Crisis (website)

Josh Bivens and Jordan Haedtler, Impressive, Incomplete, and Under Threat . Economic Policy Institute, Aug 3, 2017.

Nomi Prins, Collusion: How Central Bankers Rigged the World. Bold Type Books | Amazon page, May 1, 2018.

New York Times Editorial Board, Fed Makes a Risky Bet on Banks . New York Times, Jun 1, 2018. on loosening Dodd-Frank and debt-limits

Cezary Podkul, Gabriel Gianordoli, Jess Kuronen, Tyler Paige, Peter Santilli and Hanna Sender, Fed 10 Years After the Crisis . Wall Street Journal, Mar 27, 2018.

Karl Smith, The Uses and Abuses of Modern Monetary Theory . National Review, Jan 11, 2019. a view from the Niskanen Institute

Apples and Dragons, Game of Thrones Season 8 Prediction - The Iron Bank Debt . Apples and Dragons, Jan 19, 2019. an intriguing parallel in the fictional story Game of Thrones about the power of banks and debt on politics, war, spying, and diplomacy

CNBC, Why Australia Hasn't Had A Recession In Decades . CNBC, Feb 8, 2019. selling raw materials to China; pension reform; consumer debt reduction; independent central bank

Mike Shedlock, Ben Bernanke - The Father of Extreme US Socialism . FX Street, Mar 4, 2019. summarizes an article by David McWilliams in Financial Times that quantitative easing inflated assets for baby boomer homeowners and left millenials, who generally did not own assets, even worse off

Trevor Noah, Rutger Bregman - “Utopia for Realists” and Big Ideas for an Equitable Economy . The Daily Show, Mar 16, 2019. gives a very interesting anecdote about strikes: garbage collectors go on strike and mass panic ensues; bankers went on strike once and no one cared; telling, perhaps

Josh Hammer and Todd J. Stein, The Real Reason for Income Inequality? The Fed . Fortune, May 2, 2019. “the real reason for” is an oversimplification, but certainly “a major contributor to.” Income inequality existed in Isaiah 58 and James 5 without central banking.

Chris Miller, The Fed Is Trump’s Secret Ally in the Trade War . Foreign Policy, Jun 10, 2019. “By lowering interest rates, the body is cushioning the blow of tariffs and convincing the president that they are working”

Adam Tooze, Why Central Banks Need to Step Up on Global Warming . Foreign Policy, Jul 20, 2019. contains a chart of weather-related loss expenses, and faults the U.S. Fed for being slower than other central banks

Laurie Garrett, The World Bank Has the Money to Fight Ebola But Won’t Use It. Foreign Policy, Jul 22, 2019. “In Congo, thousands of people have died due to a misguided finance-driven approach to fighting pandemics that puts investors before victims.”

William D. Cohan, Only the Fed Can Save Us . New York Times, Aug 31, 2019. ‘In large part, the explosion of debt issuance has been driven by central-bank policies that have kept interest rates at historically low levels, in effect rewarding entities for issuing more and more debt. Interest payments on corporate debt are tax deductible, in most jurisdictions. We live in a world awash in debt. But that’s the risk we can see. There is plenty of additional risk hiding in the undisclosed obligations of private companies and in the “shadow banking system,” nonbank financial institutions that have sprung up in the past decade to hold the risk that the Federal Reserve insisted, after the 2008 financial crisis, that Wall Street avoid. So what would happen if interest rates did increase slightly, or if the economy dipped into a recession, and some of those overleveraged companies could no longer meet their interest payments? It wouldn’t be pretty.’

Andrew Cockburn, Forget Checks, How About Giving Everyone A Federal Reserve Account?. The American Conservative, Mar 21, 2020. “This is no frivolous proposal. If the banks can get access to trillions in U.S. dollars, why not you?”

Steve Liesman, Mortgage Bankers Warn Fed Mortgage Purchases Unbalance Market, Forcing Margin Calls. CNBC News, Mar 29, 2020. “The Fed bought $183 billion of purchases last week of mortgage-backed securities, in an effort to drive down rates, and they did. But the Fed’s actions, amid a volatile market environment, helped add further strains that resulted in blowing up a widespread hedge that mortgage bankers use to protect themselves against rate increases, and now some lenders are facing margin calls that are eroding their working capital and threaten their ability to operate.”

Economics Explained, Modern Monetary Theory: How it Could Answer All Of Our Economic Problems. Economics Explained, Apr 2, 2020. argues that the government collects taxes in US dollars so that we would use the currency. So if the Fed could just print money, why don’t they? To create demand for this extra currency. And to avoid inflation. The US, however, can export their inflation because it is the global standard currency. See also Joseph Brown, Do We Actually Need Taxes? The Fed Can Print Infinite Money... . Heresy Financial, Apr 24, 2020. Brown argues that US taxes are politically important to require people to use the US dollar, since the US dollar and US treasuries are the global default currency.

Joseph Brown, Is History Repeating Itself with a Fiat Collapse? | John Law and the Mississippi Bubble. Heresy Financial, May 5, 2020. For a historical parallel that is easily understandable.

Joseph Brown, Dismantling Idiotic Deflation Ideas. Heresy Financial, May 7, 2020. Brown argues deflation is a net positive for society, especially the poor; whereas inflation generally benefits the wealthy.

David Dayen, How the Fed Bailed Out the Investor Class Without Spending a Cent. The American Prospect, May 27, 2020. “Just announcing $4.5 trillion in future spending to support securities markets was enough to keep owners of capital protected from the downsides of the coronavirus.” The Fed bought corporate bonds, a remarkable bailout which floated some big companies and set their smaller competitors up to take out loans and go bankrupt. See also Rose Aguilar, The Fed Bailed Out Corporations & The Rich During COVID. Where Is Relief For The Working Class? Your Call | KALW, Jun 11, 2020. A 53 minute audio featuring David Dayen of American Prospect and Jesse Eisinger of ProPublica. Links to other links include: Jesse Eisinger, The Bailout Is Working — for the Rich (ProPublica, May 10, 2020); Jane McAlevey, We Really Need to Tax the Rich (The Nation, Jun 2, 2020); Allan Sloan, The CARES Act Sent You a $1,200 Check but Gave Millionaires and Billionaires Far More (ProPublica, Jun 8, 2020); Jessica Silver-Greenberg, Jesse Drucker, and David Enrich, Hospitals Got Bailouts and Furloughed Thousands While Paying C.E.O.s Millions (New York Times, Jun 8, 2020). This continued to be important in 2022 in debates about the causes of inflation: David Doel, Krystal Ball Dominates Bill Maher's Show With Facts. The Rational National, Jun 18, 2022. Bill Maher faulted COVID relief checks for the public as a major source of inflation.

Stephanie Kelton, The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy. Public Affairs | Amazon page, Jun 2020. A bestseller on modern monetary policy. Krystal Ball and Saagar Enjeti, Stephanie Kelton: How the Political Class Has Lied to You About Deficits. Rising | The Hill, Jun 21, 2020. But see critique by Joseph Brown, Dismantling MMT | Book Review (and thorough rebuttal) of "The Deficit Myth" - Modern Monetary Theory. Heresy Financial, Jun 12, 2020. Brown argues Kelton says conflicting things about inflation and taxation. However, Brown assumes too quickly that redistribution of wealth via taxation is inherently immoral in some sense, and that government spending will be a misallocation of resources. Brown relies on the Austrian economist Friedrich Hayek, a libertarian, who underestimates how individual spending often results in the misallocation of resources, too.

Suse Steed, How Did Houses End Up Earning More Than People? Suse Steed, Jun 1, 2020. “Because our economy is dependent on house prices rising, our politicians are too… House prices are high not because anyone did anything clever but largely because of economic policies like Quantitative Easing which I think will turn out to be profoundly stupid. High house prices aren’t something to sit around and discuss over dinner, they are something to change.”

Economic Explained, The History of Global Banking: A Broken System?. Economics Explained, Jun 21, 2020. A 22 minute video. From goldsmiths to paper receipts to fractional reserves to central banking to trust. "There isn't enough cash in existence to payoff all the debt in existence." References economic Richard Werner. See Werner’s claim that the financial sector adds no value to the economy in Alessandro Del Prete, Prof. Werner Brilliantly Explains How the Banking System and Financial Sector Really Work. Russia Today, Mar 9, 2017. Del Prete says banks borrow from the public, not take deposits, and purchase securities and therefore create the money supply. Also Richard Werner, Today’s Source of Money Creation. Monetary Institute, Apr 23, 2018. is a 15 minute video discussing three theories of banking.

Saagar Enjeti and Ryan Grim, Jon Stewart Calls Out Idiocy of Bailing Out Corporations and Not People. Rising | The Hill, Jun 29, 2020. “The financial sector needs to be a utility… If a water utility executive had eight swimming pools, and nobody else could even fill up a bathtub before it got cold, the public would say, “Wait a minute. You’re running a water utility. You’re not supposed to have all the water. You’re supposed to distribute it to everybody else. That’s what we have with Wall Street now. What ought to be a utility -- what was described as a utility in early capitalism – has developed in a way that they are keeping massive pools of this capital.”

Nomiki Konst, Alexander Hamilton Wasn’t a “Cool” Guy, He Was More of a “Really, Really Bad” Guy. The Nomiki Show, Jul 14, 2020. Matt Stoller, an anti-monopolist, points out that Hamilton wanted a military dictatorship, and settled for private central banking

Megan Henney, Fed Bought Debt from Walmart, McDonald’s, Berkshire Hathaway, and Microsoft as Part of Coronavirus Response. Yahoo News, Jun 30, 2020. “The Federal Reserve bought $428 million in corporate bonds through mid-June as part of its sweeping response to the coronavirus pandemic, making investments in well-known companies like Coca-Cola, Microsoft, McDonald’s, Walmart and a subsidiary of Warren Buffett’s Berkshire Hathaway. A transaction list disclosed by the U.S. central bank on Sunday shows the first individual company bond purchases it's made through the secondary market corporate credit facility. In total, the Fed bought debt in about 86 different companies as it tries to insulate the nation's economy from the worst downturn since the Great Depression.” Why not buy student debt? Housing mortgage debt? Consumer debt?

David Dayen, Unsanitized: The Fed’s Policy Choices and Our Maldistributed Recovery. The American Prospect, Sep 18, 2020. on the Fed supporting large corporations but not state and local governments

Krystal Ball and Saagar Enjeti, AOC-Linked Think Tank: How Biden Can Be A Truly Great President. Rising | The Hill, Nov 24, 2020. proposes that the Fed cover more State and local banks to get money into the hands of more people and small businesses, and act like a development bank for green energy and COVID recovery; features progressive think tank The New Consensus.

Joeri Schasfoort, The Monetary Financial System Visually Explained. Money & Macro, Dec 9, 2020. Presents a hierarchy of money, made of three tiers: monetary core of central bank money (including M1, M2, and M3 money, as well as reserves, that can either be created through money printing, monetary finance, or quantitative easing), a large monetary periphery of money created by private banks, and an even larger financial crust that contains all other financial instruments (such as those issued by shadow banks and money market mutual funds).

Matt Stoller, The Cantillon Effect and GameStop. Matt Stoller Substack, Jan 31, 2021. “Why our politics centers around the unreal world of finance.” The Cantillon Effect is the impact of new currency. printed money, etc.. on various players in the economy.

Richard Wolff, AskProfWolff: Comment on Modern Monetary Theory. Democracy at Work, Apr 14, 2021.

Joseph Brown, The Fed Just Lit the Fuse for a Liquidity Crisis. Heresy Financial, Jun 21, 2021. the Fed entered the repo market by injecting cash in Sep 2019; studies repo and reverse repo market

Joseph Brown, Wells Fargo Shuts Down All Personal Lines of Credit. Heresy Financial, Jul 11, 2021. when the Fed keeps interest rates low, they make it harder for banks to offer services to people, because what you lose in income per dollar, you have to make up for in volume, and you can’t do that with people. So easy money accumulates with big lenders and very wealthy people.

Joseph Brown, Manipulated Markets are Huge Opportunities to Profit. Heresy Financial, Jul 29, 2021. Brown starts with French central banker John Law in the 1700s who got people to stop using gold and silver coins, by issuing paper currency, backed by shares of the Mississippi Company which owned land. There’s a currency printed backed up by the value of an asset. But the asset is being purchased by newly printed currency. This is like the Fed printing dollars backed up by the asset Treasuries, but dollars printed are being used to purchase Treasuries. Richard Cantillon understood that this wouldn’t end well in France. So he sold his shares at the inflated price and made a fortune.

David Doel, Striking Coal Miners Take Their Fight To NYC. The Rational National, Jul 28, 2021.

Joseph Brown, Treasury Invokes 'Extraordinary Measures' as Congress Misses Debt Ceiling Deadline. Heresy Financial, Aug 2, 2021.

James Kynge and Sun Yu, Is China’s Economic Model Broken? Financial Times, Oct 15, 2021. highlight how debt-driven housing speculation contributes to why China’s housing market is close to 30% of its GDP, unlike other nations. President Xi Jin-Ping’s administration drew three red lines, dealing with debt, because Xi said, “Housing is for living, not for speculating.” See also Lei’s Real Talk, China’s Real Estate Bubble Explained and Compared to Japan’s Real Estate Crisis 1990s. Lei’s Real Talk, Oct 8, 2021. Gives a helpful comparison to low-interest monetary policy in Japan.

Bloomberg Markets and Finance, Guggenheim's Minerd Says Central Banks Have No Exit Plan. Bloomberg Markets and Finance, Oct 18, 2021. Comments that central banks were traditionally used to making minor adjustments, whereas after 2008, they are managing the economies of nations.

Joseph Brown, The Plan to Overturn the Leadership at the Fed. Heresy Financial, Oct 19, 2021. On appointments and signaling of tighter or looser money

Joseph Brown, How the Fed will Trigger a Market Crash in 2022. Heresy Financial, Oct 27, 2021. Gives a good explanation of Federal Reserve activities and their consequences, with some moral critiques. fractional reserve banking is legalized fraud. and historical perspectives on previous empires/societies where monetary policy causes over-financialization

Joseph Brown, The Next Crash Won’t Kill the Economy, But the Response Will. Heresy Financial, Oct 30, 2021. Suggests that the government will have to nationalize the Fed and the banking system, which is intriguing

Yanis Varoufakis, Technofeudalism: Explaining to Slavoj Zizek Why I Think Capitalism Has Evolved Into Something Worse. Yanis Varoufakis, Nov 1, 2021. Central banks have kept capitalism alive through easy money policies. Central bank money has replaced profit as the driver of the economy. In capitalism, exploitation takes place in markets; in feudalism, it is just expropriation. Also, the Amazon platform, like other platforms, is not a market, but a fiefdom.

Joseph Brown, The Day Capitalism Died. Heresy Financial, Dec 11, 2021. Brown argues that for capitalism to truly work, there needs to be genuine accountability and thus, failure, for poor decisions. But the Fed organized a bailout when the hedge fund Long Term Capital Management collapsed in 1998. Then in the tech stock crash of 2001, the Fed lowered interest rates to cushion the blow. That drove “a flood of money” into the housing market, and housing speculation. Then in 2009, the Fed helped out all of Wall Street by bailing them out directly. Then they had to increase their Quantitative Easing in 2018, the repo market blew up. And in early 2020, the Fed might feel the need to manage the entire economy.

Joseph Brown, How the Fed Helps Insiders Get Out at the Top. Heresy Financial, Dec 13, 2021. Lower interest rates means banks must increase their lending to keep up their revenue. The government tends to borrow, ultimately from the Fed. When the Fed spends money into existence, people will buy assets to hedge against inflation. An inflationary environment lands in the hands of companies, plus debt is cheap. So companies purchase their own stocks, to increase earnings per share.

Michael Cowan, The Fed Has Destroyed The Dream Of Retirement Forever. Michael Cowan, Jan 17, 2022. Michael puts together concerns about an aging population, declining government tax policy and increasing expenses, and inflation. Very helpful macroeconomic perspective.

Christopher Leonard, The Lords of Easy Money: How the Federal Reserve Broke the Economy. Simon & Schuster | Amazon page, Jan 2022. Amy Goodman, "The Lords of Easy Money": How the Federal Reserve Enriched Wall Street & Broke the U.S. Economy. Democracy Now, Jan 27, 2022.

Joeri Schasfoort, What is Actually Causing Inflation? A Deep Dive (ft. @Unlearning Economics). Money & Macro, Jan 26, 2022. This is an hour long video, comparing “team transitory” and “team permanent.”

Joseph Brown, Last Year Had the “Strongest Economic Growth Since 1984”. Heresy Financial, Jan 27, 2022. Brown explains why government debt achieves diminishing returns in terms of economic growth, and why household and corporate debt increases in tandem and constricts the ability of the economy to respond to monetary stimulus. The “strong economic growth” in Q4 2021 was largely the Federal Reserve’s stimulus, and the fiscal COVID relief.

Joeri Schasfoort, Why Central Banks Failed to Cause Inflation. Money & Macro, Feb 16, 2022. A short 5 minute video. QE caused asset price bubbles not consumer goods. Our economy has become much more financialized. It caused increased spending on financial products like housing, stocks, and cryptocurrency.

Jon Stewart, How Do We Fix The Economy? Modern Monetary Theory, Explained. The Problem With Jon Stewart Podcast, Feb 24, 2022. “Economists Stephanie Kelton and Rohan Grey take Jon down a Modern Monetary Theory rabbit hole, where they learn that the Fed could actually do a lot more than it is.”

Michael Cowan, We’re All About To Pay For Kicking The Can Down The Road. Michael Cowan, Apr 25, 2022. How debt is a borrowing against the future which will need to be paid back. Fed interest rates may need to be raised to the level of inflation. Globalization of supply chains — meaning, cheap labor and pollution from transportation externalized to the environment — has held inflation down for decades. Now that the supply chain globalization is being questioned, and manufacturing on-shored again, this might change.

Peter Zeihan, Inflation? We Ain’t Seen Nothing Yet. Zeihan on Geopolitics, Jul 14, 2022. Zeihan argues that soil fertilizer and food production are jeopardized by Russia’s invasion, and that the US Fed is making matters harder for Europe. The US Fed can raise interest rates because US consumption and consumption-related industries are sensitive to interest rates. But Europe’s economies are not consumption-driven. Thus, as the US dollar strengthens against other currencies, since European countries need to buy energy, food, etc. in US dollars, they are paying even more.

Daniel Boguslaw and Ken Klippenstein, The Fed Likes to Tout Its Independence, So Why Are Big Banks Lobbying It? The Intercept, Oct 26, 2022. “Unlike Trump, Biden vowed to “respect the Fed’s independence,” even as bank lobbyists continue to swarm it.”

Joeri Schasfoort, Controversial Rise of Central Banking. Money & Macro, Nov 7, 2021. An 18 minute video. Schasfoort covers the practical necessity for central banks, starting with the Southern European precursor banks, the Bank of Amsterdam from 1609, the Swedish Sveriges Riksbank, and the Bank of England.

Natalie Kitroeff, et.al., A New Plan for Student Loan Forgiveness. New York Times, Aug 26, 2022.

Joseph Brown, There is $80 Trillion in Missing Dollar Debt. Heresy Financial, Dec 7, 2022. The Fed doesn’t know where this debt actually is, what currency it is in, etc.

Benjamin Norton, NY Times is Wrong on Dedollarization: Economist Michael Hudson Debunks Paul Krugman's Dollar Defense. Geopolitical Economy Report, May 10, 2023. A 36 minute video. At issue is an understanding of what drives currencies.

Saagar Enjeti and Ryan Grim, Florida Construction Sites Empty: Is It Worth It? Breaking Points, May 23, 2023. If strawberries and orange juice cost more, then the Fed Chair says that inflation has gotten too high, raises rates, and tries to push labor costs down. Why not protect domestic labor, then use big government power to subsidize some prices of key goods?

Ben Norton, US Congress Plots to Save Dollar Dominance Amid Global De-Dollarization Rebellion. Geopolitical Economy Report, Jun 20, 2023. Video clips from Congressional Reps and economists on the advantage of dollar dominance and the implications of decline.

Keep Curious Co., How the Secret Service Was Created. Keep Curious Co., Apr 28, 2022. A 14 minute video. The Secret Service was founded to fight counterfeiting, which in 1865 was a huge problem: conservatively, a third of US currency circulating was counterfeit. The Treasury Department and Abraham Lincoln started this policing agency.

Peter Zeihan, What in the World Is Happening? Burr and Foreman LLP, Jun 29, 2023. A 90 minute video with Zeihan’s original slides rather than someone else’s graphics. Zeihan starts with demographic population data and raises the economic questions from there. The US Fed Reserve is responding to population decrease and raising interest rates to have some kind of monetary policy leverage to stimulate economic growth for when Canada, US, and Mexico have to form the main trade partnerships and leave globalization behind. The Russia and Ukraine war, Zeihan argues, is existential on both sides. The risky implications for global oil trade: China’s collapse because of their energy dependence will happen in the next decade; Russian Federation collapse because of their population decline, permafrost vulnerability, and internal ethnic conflicts like Chechnya.

Krystal Ball and Saagar Enjeti, Renter Class: Homeowner Ownership Collapses In 2023. Breaking Points, Sep 3, 2023. From close to 70% in 2007 to 59% in 2023. This is the result of a low-interest rate Fed monetary policy which made borrowing very easy, by permanent capital.

Joseph Brown, Is a Small Amount of Inflation a Good Thing? Heresy Financial, Sep 18, 2023. Argues that it is not: Technological progress should lead to deflation and the increase of real wages and purchasing power. Inflation designed by central bankers means that ordinary savings will lose value unless it is directed towards investments that central bankers believe is important, or consumption.

Aaron Bastani, American Big Tech Has Enslaved Us: Aaron Bastani Meets Yanis Varoufakis. Novara Media, Oct 8, 2023. This has major implications for Christian ethics. Varoufakis argues that technological and financial power has combined as "feudal techno-capitalism" around cloud capital. For example, Tesla is a cloud company, collecting data on its drivers, and is now joining that data with Twitter's data, which is disturbing. Varoufakis also argues that the geopolitical tension between the US and China is in large part the result of competing visions of techno-finance.

Geopolitical Economy Report, How the US Government Bailed Out Banks and Rich Oligarchs. Geopolitical Economy Report, Jan 6, 2024. The Fed raised interest rates because, in their words, they wanted to fight inflation via wage growth. But the Fed just lowered interest rates, while wages continue to rise. Corporate profiteering has been shown to be a greater recent factor in inflation, more so than wages. This was a blow to the neoliberal economic narrative that inflation is always and everywhere a monetary issue. Or the narrative that inflation is driven by labor’s demand for higher wages. Meanwhile, 56% of the government bailout amount given to Silicon Valley Bank went to oligarchs and hedge funds.

Joe Brown, The Fed’s Secret, Ongoing Bank Bailout that Just Keeps Growing. Heresy Financial, Jan 15, 2024. The Bank Term Funding Program which effective backstops US Treasuries, but closes on March 11, 2024.

Ben Casselman and Jeanna Smialek, High Interest Rates Are Hitting Poorer Americans the Hardest. New York Times, May 14, 2024. “For poorer families, it is different. They are likelier to carry a balance on credit cards, meaning they’re more likely to feel high rates…. Fed data suggests that wealth for the upper half dipped after the Fed’s initial rate increase in 2022, but is again setting records. For the bottom half, however, wealth remains below its level before the Fed began raising rates, after subtracting credit card and mortgage debt and other liabilities.”

Steve Keen, How Hitler Actually Rose To Power (Top Economist Proves). Prof Steve Keen, Aug 23, 2024. Starts with the tension/conflict between using money as a means of exchange and money as a store of value. From there, Keen discusses deflation and high unemployment. Keen spotlights the town of Wörgl in Austria which introduced a new currency, which depreciated rapidly and brought local full employment. This was called the Miracle of Wörgl. But the Austrian Central Bank sued them and stopped the new currency.

Peter Zeihan, The Federal Reserve and Its Inflation Target. Zeihan on Geopolitics, Jul 5, 2024. On the Fed’s prime rate as a regulator of demand, when demographic decline is happening and aggregate demand is declining.

Ash Sarkar and Yanis Varoufakis, "Socialism for the Bankers" Yanis Varoufakis on What Killed Capitalism? (Part 2). How to Academy, Aug 18, 2024. Nine of ten dollars Meta invested in all the cloud capital that now undergirds Meta came from the Federal Reserve.

Radhika Desai and Michael Hudson, Can the Fed Really Control Inflation? Geopolitical Economy Report, Aug 31, 2024. Desai and Hudson agree that the Fed’s real goal is to preserve asset prices like housing, real estate, and the stock market, because the Fed’s goal is to support banks, not to promote a healthy and diverse industrial economy. They argue that lowering the Fed rate therefore makes capital easier for Wall Street to buy real estate and ordinary companies. Real estate allows them to raise rents; ordinary companies allow financiers to seek cheaper labor elsewhere or strip ordinary companies down for parts.

Joseph Brown, The Fed Hasn’t Done This Since ‘01… and ‘08. Heresy Financial, Sep 9, 2024. “This” is keeping the Federal overnight rate higher than the 2 year bonds rate, which signals that most private actors believe that the natural or free market 2 year yield on an investment is lower than what the Fed asserts.

Christian Restorative Justice, Banking, and Finance: Topics:

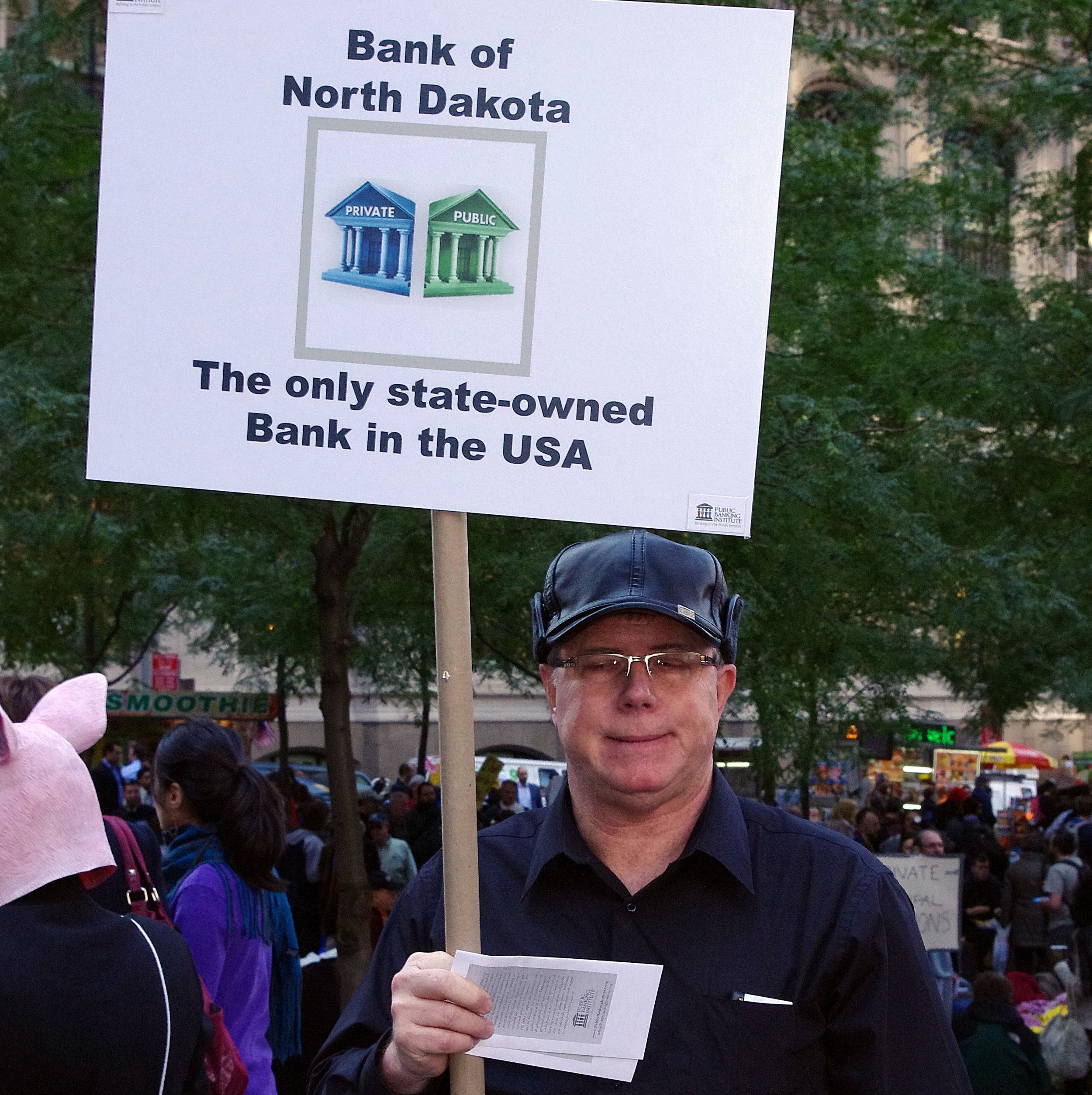

This page is part of our section on Banks and Finance, which examines the following topics: Interest Rate Lending critiques usury from multiple vantage points including the biblical, and highlights moral and economic problems associated with it. Debt Forgiveness explores the rationales and effects of forgiving debts. Corruption and Regulation demonstrates how nefarious banks and financial institutions are. Central Banks explores currency manipulation and monetary policy. Public Banks explore options like a public option for banks, postal banking, and actual examples of socialized banks. Islamic Banking examines quranic principles and examples of a different institutional framework for banking. Student Loan Debt tracks the challenges and root causes behind ballooning student loan debt in the U.S. See also Racism in Banking and Finance for resources on racism and finance.

Christian Restorative Justice Critique of the Right: Domestic Policy Topics:

This page is part of our section Critique of the Right, which engages the following topics: Banking and Finance examines the economic and political power of financial institutions; Bioethics discusses abortion policy; Business and Economics examines economic theories, taxes, housing, environment, corporate law, labor law, automation, and inequalities of wealth and power; Civil Unions makes the Christian case for civil unions for all and removing marriage from the culture wars; Criminal Justice examines crime statistics and definition, policing, prosecution, sentencing, prisons, and reintegration; Education examines public education and conservative resistance to it; Environment and Health highlights the many challenges we face related to animals, climate change, food, and health systems; Government Corruption spotlights political compromises and dealings contrary to the public good; Gun Rights examines gun policies and rhetoric; Media spotlights failures of, and possible fixes to, left-wing or left-leaning media; Power and Politics highlights the impact of racial considerations and racism on political campaigns, voting rights, public investments, and other political procedures; Race examines the impact of white supremacy on virtually every aspect of American life.