Interest Rate Lending and Debt

Photo credit: Steinchen | CC0.

Introduction

This page explores moral and ethical problems found in the practice of usury, or interest rate lending. The Christian resources here highlight the biblical condemnation of usury, as well as the various attitudes and actions that it makes possible, especially borrowing against the future and the commodification of people. The general resources highlight systemic risk or moral and political problems associated with usury, since it leads to capital consolidation. In Christian restorative justice, efforts are made to correct the exploitation of people.

Messages and Essays on Christian Restorative Justice, Banking, and Finance

A message given to New Hope Fellowship Baltimore, MD, May 2015. This explores multiple biblical passages criticizing interest rate lending. Not only was such behavior exploitative of people in poverty, even if they “consented” to their own exploitation, it reflected a relational dynamic that cannot be grounded in the Trinitarian relations between Father, Son, and Holy Spirit. See also the ppts.

Other Resources on Interest Rate Lending and Debt

Top articles: History of Financialization: Thom Hartmann, Why Financialization Damages America (w/ Prof. Richard Wolff). Thom Hartmann Program, Nov 17, 2021. Hartmann explores the history of credit-debt practices and the intertwining of people, institutions, and governments via debt. Mehrsa Baradaran, Postal Banking: An Old Solution to a New Problem. TEDxUGA, Mar 30, 2016.

Erin El Issa, American Household Credit Card Debt Study (NerdWallet) good stats

Wikipedia, Mortgage Industry in the U.S. (Wikipedia)

Wikipedia, Household Debt (Wikipedia)

Wikipedia, Equal Credit Opportunity Act (Wikipedia) the law that allowed banks to take two incomes into account for home mortgage calculations

Thomas C. Hunt, The National Defense Education Act of 1958 (Encyclopedia Britannica) the legislation that kicked off student loan programs coordinated by the federal government, to engage the Soviets in the "space race" after they launched Sputnik.

The Project on Student Debt (website)

Rolling Jubilee (website)

Trading Economics, Household Debt to GDP Ratio: 1956 - present. Trading Economics website.

Hyman Minsky, The Financial Instability Hypothesis. Bard College, May 1992. Minsky discusses inflation and debt cycles.

Scott Craig Mooney, Usury: Destroyer of Nations. Parakrisis Publications | Amazon page, 1988.

Economist, Those Medici. The Economist, Dec 23, 1999.

Economist, Damned Usurers. The Economist, Dec 23, 1999.

Warren Buffett, Berkshire Hathaway 2002 Annual Report, p.14 writes, “Large amounts of risk, particularly credit risk, have become concentrated in the hands of relatively few derivatives dealers, who in addition trade extensively with one other. The troubles of one could quickly infect the others. On top of that, these dealers are owed huge amounts by non-dealer counterparties. Some of these counterparties, as I’ve mentioned, are linked in ways that could cause them to contemporaneously run into a problem because of a single event (such as the implosion of the telecom industry or the precipitous decline in the value of merchant power projects). Linkage, when it suddenly surfaces, can trigger serious systemic problems.”

Joseph Stiglitz, Odious Rulers, Odious Debts. The Atlantic, Nov 1, 2003.

Michael Hudson, America's Monetary Imperialism. Global Dialogue, Winter/Spring 2003.

Richard Sylla and Sidney Homer, A History of Interest Rates. Wiley | Amazon page, 4th edition 2005.

Christopher Kaczor, Did the Church Change Its Stance on Usury? Catholic Answers, Jul 1, 2006.

Yaron Brook, The Morality of Moneylending: A Short History. The Objective Standard, Fall 2007. Brook argues from Ayn Rand's philosophy that usury is moral – a telling source.

Lingling Wei, Hedge Funds Help Fill Gap In Lending for Property. Wall Street Journal, Aug 27, 2008.

Michael Powell, Bank Accused of Pushing Mortgage Deals on Blacks. New York Times, Jun 6, 2009. Re: Wells Fargo in Baltimore.

Sinclair Noe, Eat the Bankers: The Case Against Usury: The Root Cause of the Economic Crisis and the Fix. CreateSpace Independent Publishers | Amazon page, Aug 2010.

Scott Schuh, Oz Shy, Joanna Stavins, Who Gains and Who Loses from Credit Card Payments? Federal Reserve Bank of Boston, August 2010.

Scott Craig Mooney, The Fall of the House of Usury: What's Wrong with the Economy and How to Fix It. Parakrisis Publications | Amazon page, Apr 2011.

David Graeber, Debt: The First 5,000 Years. Melville House | Amazon page, 2012. (pdf book). See also review by Phil Ebersole, David Graeber on Debt as a False Religion (blog, Sep 9, 2013). See also some commentary by John Green's 15 minute summary Money & Debt. Crash Course video, Jul 2014. See video: David Graber, Debt: The First 5,000 Years. Talks at Google, February 8, 2012. Graber made the case for sweeping debt cancellation because the Ancient Near East practiced regular debt jubilees, to stop oligarchs from oppressing the poor. Ancient Judaism was the most frequent. “For thousands of years, the struggle between rich and poor has largely taken the form of conflicts between creditors and debtors—of arguments about the rights and wrongs of interest payments, debt peonage, amnesty, repossession, restitution, the sequestering of sheep, the seizing of vineyards, and the selling of debtors' children into slavery. By the same token, for the past five thousand years, popular insurrections have begun the same way: with the ritual destruction of debt records—tablets, papyri, ledgers; whatever form they might have taken in any particular time and place… Beginning with a sharp critique of economics (which since Adam Smith has erroneously argued that all human economies evolved out of barter), Graeber carefully shows that everything from the ancient work of law and religion to human notions like "guilt," "sin," and "redemption," are deeply influenced by ancients debates about credit and debt.”

Eric Vieth, Mortgage Crisis in a Nutshell - Presented by John Campbell. Erich Veith channel, Apr 21, 2012.

Baltimore Sun, Wells Fargo Settlement: A Predatory Lender Pays Up Baltimore Sun, Jul 15, 2012.

Dr. Mercola, Surprising Links: How Big Banks Manipulate and Influence Your Health. Mercola, Jul 15, 2012.

Dan Caplinger, Private Student Loans are the Subprime Mortgages of the College World. Daily Finance, Jul 20, 2012.

Jim Gallagher, Illinois Law Limits "Debtor's Prison". St. Louis Post Dispatch, Jul 26, 2012.

Michael Hoffman, Usury in Christendom: The Mortal Sin that Was and Now is Not. Independent History and Research | Amazon page, Nov 2012.

Charles R. Geisst, Beggar Thy Neighbor: A History of Usury and Debt. University of Pennsylvania Press | Amazon page, Apr 2013. See also (pdf file) and review.

Pete Daniel, Dispossession: Discrimination Against African-American Farmers in the Age of Civil Rights. University of North Carolina Press | Amazon page, Mar 29, 2013. See also review by Vann R. Newkirk II, The Great Land Robbery. The Atlantic, Sep 2019. “President Franklin D. Roosevelt’s New Deal life raft for agriculture helped start the trend in 1937 with the establishment of the Farm Security Administration, an agency within the Department of Agriculture. Although the FSA ostensibly existed to help the country’s small farmers, as happened with much of the rest of the New Deal, white administrators often ignored or targeted poor black people—denying them loans and giving sharecropping work to white people… [T]he USDA became the safety net, price-setter, chief investor, and sole regulator for most of the farm economy in places like the Delta. The department could offer better loan terms to risky farmers than banks and other lenders, and mostly outcompeted private credit. In his book Dispossession, Daniel calls the setup “agrigovernment.” Land-grant universities pumped out both farm operators and the USDA agents who connected those operators to federal money. Large plantations ballooned into even larger industrial crop factories as small farms collapsed. The mega-farms held sway over agricultural policy, resulting in more money, at better interest rates, for the plantations themselves. At every level of agrigovernment, the leaders were white.”

Yves Smith, Do Banks Create Money from Thin Air? Naked Capitalism blog, Jun 6, 2013.

Samir Abid Shaikh, The Anatomy of Usury: A Critique of the Interest-Based Economic System. CreateSpace Independent Publishing | Amazon page, Sep, 2013.

Thom Hartmann, Private Debt - Not Government Debt - Will Destroy America. Truthout, Feb 14, 2013.

Amy Traub, Discredited: How Employment Credit Checks Keep Qualified Workers Out of a Job. Demos, Mar 2013.

Matt Phillips, Here’s How Warren Buffett Made $3.1 Billion on His Crisis-Era Bet on Goldman Sachs. Quartz, Mar 26, 2013. Even though it was an equity stock purchase, the guarantees of preferred stock is interesting.

Kari Koch, Fannie Mae Evicts Family in Foreclosure, Then Installs Armed Guards. Truthout, Apr 30, 2013.

Jerome Roos, Financial Empire and the Global Debtors' Prison. Roar Magazine, May 6, 2013.

Noam Chomsky, The Corporatization of the University. UM GEO channel, Jul 12, 2013. YouTube video that is 1 hr 40 min total.

Sam Seder, Fannie, Freddie, and the Next Housing Crisis, with David Dayen. The Majority Report with Sam Seder, Aug 7, 2013.

Thomas B. Edsall, Making Money Off the Poor. New York Times, Sep 17, 2013. “A lot of people are making money off the poor. The Center for Responsible Lending, a North Carolina nonprofit that tracks predatory lending practices, issued a revealing report earlier this month on payday loans, which carry annual interest rates as high as 400 percent. Using data compiled by the Consumer Financial Protection Bureau, the center found that most borrowers repeatedly rolled over or renewed loans.”

Bill Swindell, Gretchen Wright, Shannon Gallegos, New Data Confirm Troubling Student Loan Default Problems. Project on Student Debt, TICAS, Sep 30, 2013.

Niall McLaren, Dumbing Down America: The Decline of Education in the US as Seen From Down Under. Truthout, Nov 22, 2013.

Laura Gottesdeiner, The Empire Strikes Back How Wall Street Has Turned Housing Into a Dangerous Get-Rich-Quick Scheme -- Again. TomDispatch, Nov 26, 2013.

Ronan Keenan, What's Behind America's Soaring College Costs? The Atlantic, Apr 10, 2014.

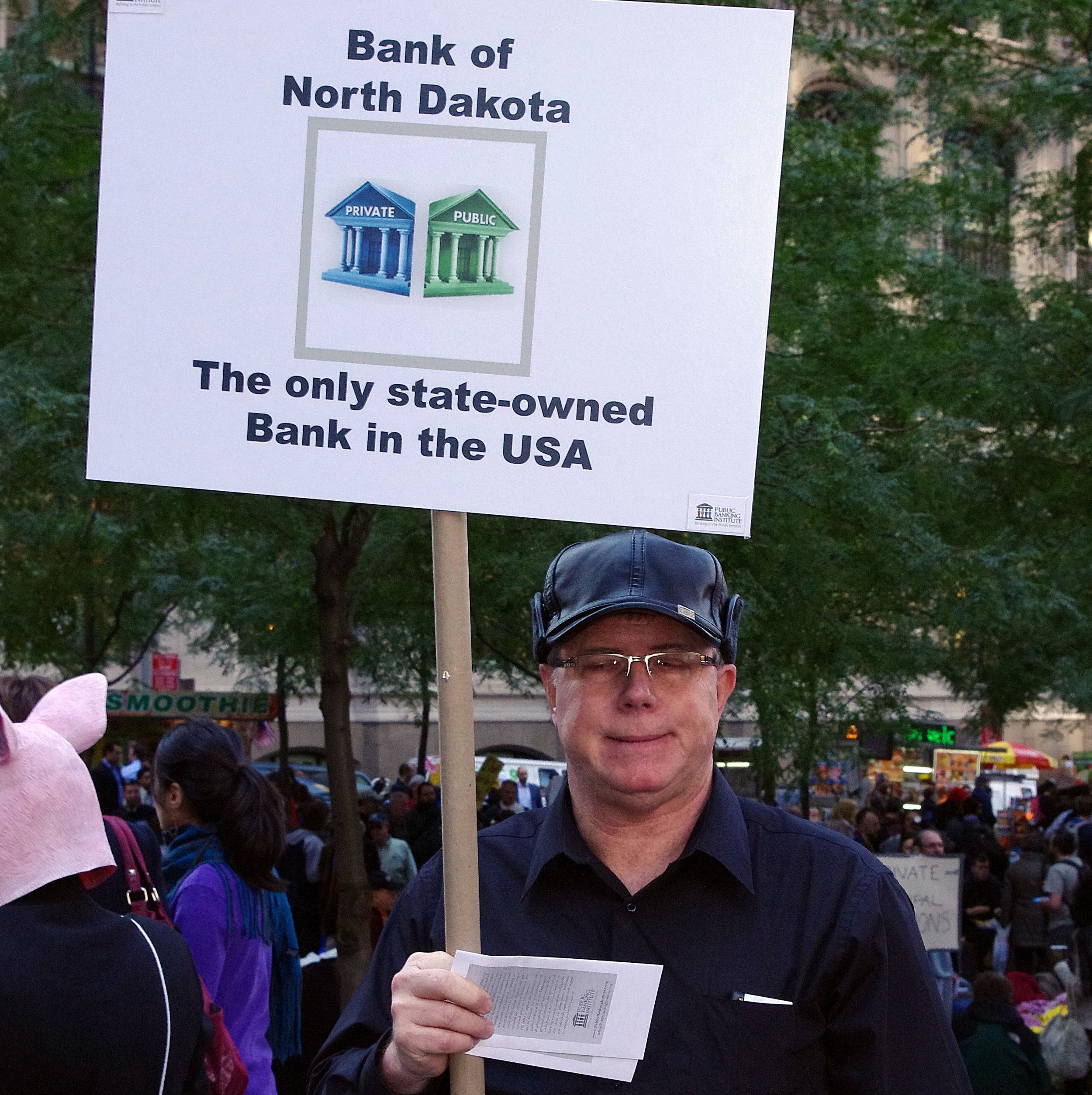

Demos, How State Banks Can Reduce Student Debt. Demos, Apr 24, 2014.

Richard Fry, Young Adults, Student Debt, and Economic Well-Being. Pew Research, May 14, 2014.

Josh Boak, Study: 35 Percent in US Facing Debt Collectors. ABC News, Jul 29, 2014.

Phil Izzo, One in Three Americans Has Debt in Collections: So What? Wall Street Journal, Jul 29, 2014.

Hadley Malcolm, A Third of Americans Delinquent on Debt. USA Today, Jul 29, 2014.

John Oliver, Predatory Lending. Last Week Tonight video, Aug 10, 2014.

John Oliver, Student Debt. Last Week Tonight, Sep 7, 2014. Oliver focuses on for-profit schools.

Heather Perlberg, John Gittelsohn, and Clea Benson, Hedge Funds Reap Gains on FHA Loans Sidelining Nonprofits. Bloomberg Business, Sep 8, 2014.

Anya Kamenetz, These People Can Make Student Loans Disappear. NPR, Sep 17, 2014. About Rolling Jubilee.

Chris Maisano, Friendly FIRE: Social Impact Bonds Offer Private Interests Yet Another Opportunity to Enrich Themselves at Public Expense. Jacobin, Oct 2014.

David Dayen, Big Banks’ Stunning Setback: Meet Two Officials Saying No to Bank of America. Salon, Oct 28, 2014.

Claire Lee, Debt Behind Korea's Notorious Suicide Rate. Korea Herald, Nov 16, 2014.

David Dayen, “An Ongoing Criminal Enterprise”: Why America’s Housing Disaster is Back and Wreaking Terror. Salon, Nov 18, 2014.

Jennifer Siegel, For Peace and Money: French and British Finance in the Service of Tsars and Commissars. Oxford University Press | Amazon page, 2014. See book review by William Anthony Hay, The Debtor's Road to Peace and Prosperity. The American Conservative, May 19, 2015.

Eberhard Arnold, The Economy of the Early Church: Why the Early Church Abandoned Private Property. Plough, Jan 5, 2015.

David Dayen, “We Know Exactly Who Today’s Dream Killers Are”: Why Postal Banking is So Needed — and on the Rise. Salon, Jan 20, 2015.

Rick Noack, Croatia Just Canceled the Debts of Its Poorest Citizens. Washington Post, Jan 31, 2015.

Tim Donovan, Student Loan Breakthrough? Why a New Victory Has Lessons for Stopping the Madness. Salon, Feb 17, 2015.

David Dayen, America’s Student Loan Boycott: How 15 Students Took on the Government — and Just May Win. Salon, Mar 3, 2015.

David Dayen, “Not True and They Knew It”: What Rahm Emanuel’s Wall Street Craze Cost Chicago. Salon, Mar 17, 2015.

CNN News, What an Interest Rate Increase Means for Real People. CNN News, Mar 19, 2015.

David Dayen, Barney Frank Drops a Bombshell: How a Shocking Anecdote Explains the Financial Crisis. Salon, Mar 31, 2015.

Stephen Freeman, No More Debt. Ancient Faith blog, Apr 13, 2015. An Eastern Orthodox critique of modern finance based on atonement theology.

David Dayen, Wall Street’s Favorite Myth Just Got Busted: The Rise of “Shadow Banking” and the Fall of GE Capital. Salon, Apr 14, 2015.

Janet Lorin, Fed: People With Old Student Loans Are Struggling to Pay Them Back. Bloomberg, Apr 16, 2015.

Tom Strode, Payday Loans Targeted by ERLC, Others in Coalition. Baptist Press, May 15, 2015.

Greg Robb, The Fed Fears Lifting Interest Rates, Ex-Insider Says. Market Watch, Jun 11, 2015.

Martha C. White, Widow's Reverse Mortgage 'Nightmare' Underscores Lifeline's Risks. NBC News, Jul 2, 2015.

Bonnie Kristian, Study: Federal Student Loans Increase Tuition, Not Enrollment. The Week, Jul 7, 2015.

Paul Kiel and Annie Waldman, The Color of Debt: How Collection Suits Squeeze Black Neighborhoods. ProPublica, Oct 8, 2015.

Matthew Yglesias, Hillary Clinton's Plan to Tame Big Banks Shows Her at Her Wonkish Best. Vox, Oct 9, 2015.

Steve Roth, Why Tyler Cowen Doesn't Understand the Economy: It's the Debt, Stupid. Asymptosis blog, Nov 16, 2015.

Paul Langley, Liquidity Lost: The Governance of the Global Financial Crisis. Oxford University Press | Amazon page, 2015. Langley is not a Christian author that I know of, but this book is invaluable as a record of how Anglo-American bankers and politicians defined the financial crisis of 2008. They defined it in terms of liquidity with regards to themselves (to which the answer was "quantitative easing"), but in terms of risk of default with regards to Greece (to which the answer was "austerity"). This suggests that some people get to define problems and solutions for political reasons, where the labeling of the crisis already prescribed a solution, and how the labeling favored Anglo-Americans and crippled everyone else; this is an excellent study in cultural anthropology; see also book review by Sarah Hall. Journal of Cultural Economy, Jul 2015. See review by Journal of Cultural Economy.

Paul Kiel, Small Debt is Destroying Black Lives: Institutional Racism and the Wealth Gap America Still Refuses to Acknowledge. Salon, Jan 9, 2016.

John S. Allen, The Big Home Ownership Lie: Greed, Fear, and How the Big Banks Exploited a Human Need. Salon, Jan 9, 2016.

Peter Eavis, Toxic Loans Around the World Weigh on Global Growth. New York Times, Feb 3, 2016.

Kerry Bolton, Tradition and Usury: The Perennial Conflict. Katehon blog, Feb 16, 2016.

Whitney Benns and Blake Strode, Debtor's Prison in 21st Century America. The Atlantic, Feb 23, 2016.

Deidox, The Ordinance (website, documentary)

Steve Eisman, Don't Break Up the Banks; They're Not Our Real Problem. New York Times, Feb 6, 2016. Leveraged debt is the real problem.

Mehrsa Baradaran, Postal Banking: An Old Solution to a New Problem. TEDxUGA, Mar 30, 2016.

Charlene Crowell, Pastors Call Payday Lending Immoral. St. Louis American, Apr 21, 2016.

Chris Kirk, Five Charts That Show Americans Families’ Debt Crisis. Slate, May 12, 2016.

Newser Editors, Average Size of US Homes, Decade by Decade. Newser, May 29, 2016. A mark of how debt inflates home sizes.

John Oliver, Debt Buyers. Last Week Tonight, Jun 5, 2016.

Kathy Orton, Student Loan Debt is Hurting the Housing Market, Survey Finds. Washington Post, Jun 13, 2016.

James B. Steele and Lance Williams, Who Got Rich Off the Student Debt Crisis. Reveal News, Jun 28, 2016.

Andrew Donohue, The Takeaway: How Privatization Changed the Student Loan Game. Reveal News, Jun 28, 2016.

Reveal News, Who's Getting Rich Off Your Student Debt? Reveal News, Jul 2, 2016.

Tom Petruno, Another Financial Crisis? Soaring World Debt Since 2008 Raises Risk as World Economy Sputters. Los Angeles Times, Jul 9, 2016.

Josh Marshall, Trump & Putin. Yes, It's Really a Thing. Talking Points Memo, Jul 25, 2016. On Trump's indebtedness to Russian financiers close to Putin.

Nathan McAlone, The Tech Industry's New Perk: Zero-Down Mortgages on Up to $2 Million Homes. Business Insider, Jul 27, 2016.

John Oliver, Auto Lending. This Week Tonight, Aug 14, 2016. Predatory lending

US Uncut, A Trump Building Is Close To A Billion Dollars In Debt; You’ll Never Guess The Lender. US Uncut, Aug 21, 2016.

Dan Carter, Race's Role in Predatory Lending. Shared Justice, Sep 12, 2016.

Bob Bryan, One of the Key Forces Behind the Bubbles That Led to the Financial Crisis Is Back. Business Insider, Sep 18, 2016. Re: debt.

Michael Pento, The Coming Bond Bubble Collapse. Peak Prosperity, Sep 18, 2016.

Ambrose Evans-Pritchard, China Facing Full-Blown Banking Crisis, World's Top Financial Watchdog Warns. Telegraph, Sep 19, 2016. Warns about debt-driven economic growth.

Alana Semuels, Finance is Ruining America. The Atlantic, Sep 23, 2016.

Jon Gorey, How Student Loan Debt Causes a Chain Reaction in the Housing Market. Boston Globe, Sep 30, 2016.

Deepti Asthana, Stories of Survival: Widows of India's Farmer Suicides. Aljazeera, Nov 3, 2016.

Helaine Olen, America’s Foreclosure Crisis Is Far From Over. So Why Don’t We Hear About It? Salon, Nov 10, 2016.

The Young Turks, Trump Wants To Ban Federal Student Loans. The Young Turks, Nov 19, 2016. Compares Elizabeth Warren's proposal to Trump's.

Rachel Koning Beals, These Countries Are Saddled With the Most Debt Per Person, In One Chart. MarketWatch, Nov 23, 2016. Re: levels of public, govt debt.

Zach Carter, The Student Debt Crisis Is Driving Elderly People Into Poverty. Huffington Post, Dec 20, 2016.

Matt Bruenig, The Rich Already Have UBI. Jacobin Magazine, Jan 2, 2017. “10 percent of all national income is paid out to the 1 percent as capital income. Why not give it to all as a universal basic income?” Dividends, interest, rents, etc.

Sarah Mulholland, A $90 Billion Debt Wave Shows Cracks in U.S. Property Boom. Bloomberg, Jan 24, 2017.

Richard Werner, How the Banking System and Financial Sector Really Work. Alessandro Del Prete, Mar 9, 2017. GDP analysts don’t know how to account for the financial sector; their value-added is zero, even negative. Werner argues for decentralized, small banks. Werner says banks borrow from the public (not take deposits) and purchase securities and therefore create the money supply. Werner argues that the financial sector adds no value to the economy. See also Richard Werner, Today’s Source of Money Creation. Monetary Institute, Apr 23, 2018. A15 minute video discussing three theories of banking. See also Economic Explained, The History of Global Banking: A Broken System? Economics Explained, Jun 21, 2020. A 22 minute video. From goldsmiths to paper receipts to fractional reserves to central banking to trust. "There isn't enough cash in existence to payoff all the debt in existence." References economic Richard Werner.

Stacy Cowley and Jessica Silver-Greenberg, Loans ‘Designed to Fail’: States Say Navient Preyed on Students. New York Times, Apr 9, 2017.

Jörg Guido Hülsmann, The Cultural Consequences of the Federal Reserve. Mises Institute, Jun 1, 2017. Inflation incentivizes indebtedness.

Alex Mayyasi, Of Money and Morals: How Did Usury Stop Being a Sin and Become Respectable Finance? Aeon, Jul 7, 2017.

American Herald Tribune, Bolivia’s President Declares ‘Total Independence’ From World Bank And IMF. Mint Press News, Jul 24, 2017. See also Whitney Webb, Bolivia Asserts Newfound Economic Independence, Rejects Rothschild Banks. Mint Press News, Nov 18, 2016.

Maria Lamagna, Americans Now Have the Highest Credit-Card Debt in U.S. History. MarketWatch, Aug 8, 2017.

Matt Townsend, Jenny Surane, Emma Orr and Christopher Cannon, America’s ‘Retail Apocalypse’ Is Really Just Beginning. Bloomberg, Nov 8, 2017.

David Dayen, The Cause and Consequences of the Retail Apocalypse. New Republic, Nov 14, 2017. Private equity firms overburdened retail with debt

Meagan Day, The Shark and the Hound. The Baffler, Dec 2017. A history of American predatory lending.

Zeke Faux, Millions Are Hounded for Debt They Don’t Owe. One Victim Fought Back, With a Vengeance. Bloomberg, Dec 6, 2017.

Tanvi Mishra, One Nation, Under the Weight of Crushing Debt. CityLab, Dec 8, 2017.

Ben Chu, Global Debt: Why Has It Hit an All-Time High? And How Worried Should We Be About It? UK Independent, Jan 5, 2018.

Michelle Singletary, Don't Spend More Than You Can Afford for Your Child's Education. Boston Globe, Jan 6, 2018.

Aaron Glantz and Emmanuel Martinez, For People of Color, Banks Are Shutting the Door to Homeownership. Reveal News, Feb 15, 2018.

Rachel Cohen, There’s Finally A Legitimate Alternative To Payday Lending. Huffington Post, Apr 12, 2018.

Ellen Brown, The Fox in the Hen House: Why Interest Rates Are Rising. Truthout, Apr 25, 2018.

TomDispatch, Donald Trump and the Next Crash. Huffington Post, Apr 27, 2018. About Trump’s Fed appointees.

Laura Sullivan, How Puerto Rico's Debt Created A Perfect Storm Before The Storm. NPR, May 2, 2018.

Ari Melber, The Why Robert Mueller 'Following the Debt' Scares Trump. MSNBC, Mar 8, 2018. How debt is part of the political economy, not simply the economy, as a neutral object. Debt is political and, at times, a weapon.

Trevor Noah, Fraudulent For-Profit Schools Make a Comeback Under Betsy DeVos. The Daily Show, May 16, 2018. See also The Young Turks, Betsy DeVos Caught Getting Rich from Fraud. The Young Turks, May 15, 2018.

NY Times Editorial Board, Fed Makes a Risky Bet on Banks. New York Times, Jun 1, 2018. On loosening Dodd-Frank and debt-limits.

Catherine Bosley, Future of Swiss Banking Hangs in Balance as Voters Head to Polls. Bloomberg, Jun 7, 2018. Fractional reserve banking creates "money"; not enough support politically but fascinating to follow

Amanda Terkel, Arthur Delaney, and Zach Carter, Behind The Scenes Of The Bruising Bank Fight That Divided Senate Democrats. Huffington Post, Jun 7, 2018. Examines the political maneuverings.

The Young Turks, The Housing Bubble is About to Burst. The Young Turks, Jun 12, 2018. Examines non-bank lenders who are predatory, and the coming wave of defaults; see original study by Brennan Hoban, The Mortgage Market Risk No One's Talking About, Plus a Proposal to Redesign the System. Brookings Institute, Mar 8, 2018. See also update by Robert C. Pozen and Clayton Pfannenstiel, Shifting the Risk of Mortgage Defaults from Taxpayers to Investors. Brookings Institute, Jun 5, 2018.

Arielle Gray, I Couldn’t Afford To Pay My Student Loans. Then I Received A Warrant For My Arrest. Huffington Post, Jun 22, 2018. Highlights many of the dangers of student loan arrangements.

Ben White, Are We Really Safe from the Next Financial Crisis? Politico, Jul 18, 2018. Experts debate whether the system is better or whether we've just been lucky.

Tara Siegel Bernard, ‘Too Little Too Late’: Bankruptcy Booms Among Older Americans. New York Times, Aug 5, 2018. Because parents are sharing more in the student loans of their children, and also going bankrupt from health emergencies

Emily Stewart, The Trump Administration Is Dismantling Financial Protections for the Military. Vox, Aug 14, 2018. Because predatory lenders go after former military members.

Ben Miller, The Student Debt Problem Is Worse Than We Imagined. New York Times, Aug 25, 2018. Newly released federal information shows that 30% of students repaying loans were in serious trouble.

Emily Stewart, The Government's Top Student Loan Watchdog Is Quitting in Protest. Vox, Aug 27, 2018. Within the CFPB. See also Cory Turner, The Why Public Service Loan Forgiveness Is So Unforgiving. NPR, Oct 17, 2018.

S-Rank TV, The Bank That Almost Broke Britain. S-Rank TV, Oct 3, 2018. An hour long documentary about the Royal Bank of Scotland and the financial crisis of 2008.

Stacy Cowley, 28,000 Public Servants Sought Student Loan Forgiveness. 96 Got It. New York Times, Sep 27, 2018.

Tom Porter and Reuters, Trump American Household Debt Is Nearly a Trillion Dollars Higher Than It Was Before the 2008 Recession. Newsweek, Nov 17, 2018.

Hunter Derensis, The Coming Bankruptcy of the American Empire. The American Conservative, Nov 20, 2018.

Harry Cheadle, Millennials Aren't 'Killing' Industries, We're Just Broke, Study Finds. Vice, Nov 30, 2018. Refers to a Federal Reserve study

Chico Harlan, Where Are All the Children? How Greece’s Financial Crisis Led to a Baby Bust. Washington Post, Dec 1, 2018.

Michael Stratford, Trump Administration Hid Report Revealing Wells Fargo Charged High Fees to Students. Politico, Dec 10, 2018.

Jerry Ashton, Robert Goff, Craig Antico, and Judah Freed, End Medical Debt: Curing America's $1 Trillion Unpayable Healthcare Debt. Hoku House | Amazon page, Dec 4, 2018. See also video news interview by Cenk Uyghur, Medical Debt is Ravaging America. Rebel HQ, Jan 4, 2019.

Barbara Boland, Ignoring America’s Abyss of Debt. The American Conservative, Feb 15, 2019. Mostly public and federal debt.

Hasan Minhaj, Student Loans. Patriot Act, Feb 24, 2019.

Franklin Foer, Russian-Style Kleptocracy Is Infiltrating America. The Atlantic, Mar 2019. “Washington had placed its faith in the new regime’s elites; it took them at their word when they professed their commitment to democratic capitalism. But Palmer had seen up close how the world’s growing interconnectedness—and global finance in particular—could be deployed for ill. During the Cold War, the KGB had developed an expert understanding of the banking byways of the West, and spymasters had become adept at dispensing cash to agents abroad.” Even if there were no money laundering in a formal sense, the reality that debt is a political factor, not just a neutral, economic factor, is important.

Steve Inskeep, Christine Lagarde Watches for Dark Clouds on the Economic Horizon. NPR, Mar 8, 2019. IMF Director Lagarde points out that banks headed by women are financially healthier and take on fewer risks; however, there is some systemic bias against women in finance, as only 2% of banks worldwide have women CEO's, and 20% of board members are women. This confirms the observation about Iceland's banking experience, as related to gender, by Michael Lewis, Boomerang: Travels in the New Third World. W.W. Norton & Company | Amazon page, Oct 3, 2011.

Gabriel Debenedetti, Wall Street Democrats Are Absolutely Freaking Out About Their 2020 Candidates. New York Magazine, Apr 28, 2019. Very revealing about the captivity of the Democratic Party to finance.

Veronique de Rugy, Corporate Welfare Wins Again in Trump’s Washington. New York Times, May 7, 2019. “We don’t need the Export-Import Bank, which pads the profits of politically connected corporations on the taxpayer’s dime, but it’s back anyway.”

David Doel, Alexandria Ocasio-Cortes & Bernie Team Up To Take On Wall Street Greed. The Rational National, May 9, 2019. Proposing a cap of 15% interest on consumer debt, including credit cards and payday loans. A response to the Fed study showing that half of Americans have no savings. In principle, this is a return to anti-usury laws. The legislation also considers postal banking.

Sean Illing, How the Baby Boomers Wrecked the Economy for Millenials. Vox, May 22, 2019. A conversation with author and WSJ columnist Joseph Sternberg; Sternberg admits his bias as a free-market conservative to avoid examining the financial sector, etc.

Independent Trader Team, China Crushed By Debt. Seeking Alpha, May 22, 2019. How indebtedness exposes Chinese companies, and China as a nation, to trade and economic uncertainties

The Young Turks, Alexandria Ocasio-Cortez And Elizabeth Warren Put Steve Mnuchin On Blast. The Young Turks, May 23, 2019. How hedge-fund manager Eddie Lampert became CEO and placed Steve Mnuchin on the board so he could asset-strip Sears, buy Sears property himself and rent it back to Sears at prices he set himself, and drive Sears into debt from private equity and his own hedge-fund while issuing stock-buybacks to profit himself. See also The Young Turks, Why Sears Bankruptcy Should Outrage You. The Young Turks, Dec 17, 2018. On how private equity companies destroy other solid corporations; and how other media companies do not cover it accurately; Sears execs will make huge bonuses for the bankruptcy proceedings, while workers make nothing. See also Bess Levin, Did Steven Mnuchin Help His College Roommate Steal $2 Billion? Vanity Fair, May 23, 2019.

Steven Pearlstein, The Shadow Banks Are Back With Another Big Bad Credit Bubble. Washington Post, May 31, 2019.

Brett Christophers, How Financial Giants Might Come to Rule Us All. Jacobin Magazine, Jun 18, 2019.

Elizabeth Warren, The Coming Economic Crash — And How to Stop It. Medium, Jul 22, 2019. See summary by The Young Turks, The Economy is About to Crash! Elizabeth Warren Sounds the Alarm. The Young Turks, Jul 22, 2019. Focusing on private debt and corporate debt that reduces resiliency to events that affect the economy.

Mihir Sharma, China’s Got the World by Its Throat. Bloomberg, Jul 17, 2019. “Developing countries owe Beijing a lot more money than is commonly realized. This is how empires start.”

AnnaMaria Andriotis, Ken Brown, and Shane Shifflett, Families Go Deep in Debt to Stay in the Middle Class. Wall Street Journal, Aug 1, 2019. “Wages stalled but costs haven’t, so people increasingly rent or finance what their parents might have owned outright”

Olga Khazan, What Happens When You Don’t Pay a Hospital Bill. The Atlantic, Aug 28, 2019. “As Americans sink under medical expenses, debt collectors go to great—and sometimes strange—lengths to collect.”

William D. Cohan, Only the Fed Can Save Us. New York Times, Aug 31, 2019. “In large part, the explosion of debt issuance has been driven by central-bank policies that have kept interest rates at historically low levels, in effect rewarding entities for issuing more and more debt. Interest payments on corporate debt are tax deductible, in most jurisdictions. We live in a world awash in debt. But that’s the risk we can see. There is plenty of additional risk hiding in the undisclosed obligations of private companies and in the “shadow banking system,” nonbank financial institutions that have sprung up in the past decade to hold the risk that the Federal Reserve insisted, after the 2008 financial crisis, that Wall Street avoid. So what would happen if interest rates did increase slightly, or if the economy dipped into a recession, and some of those overleveraged companies could no longer meet their interest payments? It wouldn’t be pretty.”

Brian M. Rosenthal, Reckless Loans Devastated Taxi Drivers. Now Prosecutors Are Investigating. New York Times, Sep 10, 2019. Exploitative lending practices associated with buying a taxi medallion, a city permit allowing ownership of a cab. “It could reverberate throughout the city’s taxi industry, which has been engulfed in a financial crisis and rocked by a string of suicides among cabdrivers. More than 950 drivers have filed for bankruptcy, and many more are still buried in overwhelming debt today.”

Morgan Simon, GEO Group Runs Out of Banks as 100% of Banking Partners Say ‘No’ to the Private Prison Sector. Forbes, Sep 30, 2019. Interesting example of the leverage that private banks have.

Elena Botella, I Worked at Capital One for Five Years. This Is How We Justified Piling Debt on Poor Customers. New Republic, Oct 2, 2019. “The subprime lending giant is a textbook case in creating a corporate culture of denial.”

Aaron Glantz, Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American Dream. Custom House | Amazon page, Oct 15, 2019. See interview by Amy Goodman and Aaron Glantz, Homewreckers: How Wall Street, Banks & Trump’s Inner Circle Used the 2008 Housing Crash to Get Rich. Democracy Now, Oct 15, 2019. See also Krystal Ball and Saagar Enjeti, Author Exposes Kamala Harris' Troubling Record on Banks in California. Rising | The Hill, Nov 11, 2019.

ABC News, How Australia Became the World Record Holder for Debt. 7.30 | ABC News, Nov 19, 2019. Consumer debt nears 200% of income

Sam Seder, How Global Finance Preys On Us All. The Majority Report with Sam Seder, Nov 17, 2019. Interviews Nicholas Shaxson, The Finance Curse: How Global Finance is Making Us All Poorer. Grove Press | Amazon page, 2019.

Anneken Tappe, The World is Drowning in Debt. CNN, Jan 14, 2020. “Global debt, which comprises borrowings from households, governments and companies, grew by $9 trillion to nearly $253 trillion” in 2019. Global debt-to-GDP ratio is 322%. “More than half of this enormous number was accumulated in developed markets, such as the United States and Europe, bringing their debt-to-GDP ratio to 383% overall.” China 310%.

The Young Turks, How Big Banks Fund the Climate Crisis. The Young Turks, Jan 19, 2020. JP Morgan Chase lent $195 billion to fossil fuel companies. Wells Fargo $151 billion. Citibank $129 billion. Bank of America $106 billion.

Gwynn Guilford, What Interest Rates Dating Back to 1311 Tell Us About Today’s Global Economy. Quartz, Jan 19, 2020.

Ross Larsen, Sonali Basak and Sridhar Natarajan, Guggenheim Says Market a ‘Ponzi Scheme’ That Must Collapse. Bloomberg, Jan 21, 2020. Cycles are caused by interest rate lending and financial instruments of increasing risk, which at some point fail to yield a return because of the last, most gullible investor who made the most risky bet and lost.

John Iadarola and Jayar Jackson, Minority Graduates Targeted In MAJOR College Scandal. The Damage Report, Feb 12, 2020. Higher rate loans given to students going to HBCU’s and colleges in more Latino areas.

The Young Turks, Bloomberg Blames Minorities For 2008 Stock Market Crash. The Young Turks, Feb 12, 2020. Gives a very succinct explanation for how banks offered high risk loans to prospective homebuyers and then bet against them in the derivatives market. Bloomberg then blamed “poor people” for taking out the loans.

Patrick Greenfield and Jonathan Watts, JP Morgan Economists Warn Climate Change is Threat to Human Race. The Guardian UK, Feb 21, 2020. The profit motive of private investment banking.

Krystal Ball and Saagar Enjeti, Zach Carter: Dem Leadership Realizes They Screwed Up Bailout. Rising | The Hill, Apr 3, 2020. Comments on the derivative market: bond ratings groups downgraded certain bonds to junk bonds, but because so much debt and derivatives are now offshored, we do not have visibility into it.

Editorial Board, Debt Forbearance as a Tool to Defeat the Pandemic. Christian Science Monitor, Apr 17, 2020. To prevent evictions, small business bankruptcy, etc.

David Dayen, USAA Grabs Coronavirus Checks From Military Families. The American Prospect, Apr 16, 2020. “The bank, one of the nation’s largest, has told customers it would use the $1,200-per-person payments to offset existing debts.” USAA backed off: Jake Johnson, Outrage Over Plan to Seize Stimulus Payments Forces At Least One Bank to Reverse Course. Salon, Apr 17, 2020. But it is very likely that this government bailout/stimulus goes to keep banks and lenders afloat. Why not just let those lenders fail, and build a public taxpayer-funded community bank in their place? And/or nationalize and democratize the Federal Reserve?

Anand Giridharadas, Blackstone Giveth and Blackstone Taketh. Seat at the Table | Vice News, May 13, 2020. Private equity firms like Blackstone launder their reputations while sinking health care companies through leveraged buyouts

Heather Vogell, Whistleblower: Wall Street Has Engaged in Widespread Manipulation of Mortgage Funds. ProPublica, May 15, 2020. “Securities that contain loans for properties like hotels and office buildings have inflated profits, the whistleblower claims. As the pandemic hammers the economy, that could increase the chances of another mortgage collapse.”

Farron Cousins, Trump Organization Begs For Rent Forgiveness For Florida Golf Course. Ring of Fire, Jun 21, 2020. Good example of how banks should be made to eat loss of rent payments

Second Thought, America's Looming Eviction Crisis. Second Thought, Jul 17, 2020. Notes that the private equity firm Blackstone bought 30,000 homes during the financial crisis of 2008-09, and private equity firms are not likely to be kind landlords during the COVID pandemic

Suse Steed, COVID Is an Opportunity to Cancel Debts. So Why Do We Keep Taking On More? Suse Steed, Aug 21, 2020. A British economist addresses private indebtedness.

The Economist, Public Debt: How Much Is Too Much? The Economist, Sep 8, 2020. The modern consensus is that austerity in a time of economic hardship and contraction is self-defeating, so governments should grow the economy by going into debt. Personally, this reliance on debt-spending seems like a political reluctance to tax wealth.

Robert Reich, Racism is Profitable. Robert Reich, Sep 15, 2020. A 5.5 minute video. Wall Street banks have extended massive credit lines to for-profit prisons and other elements of the criminal justice system; other political elements covered, too, such as voter suppression

Economics AltSimplified, America's Debt Problem: How the Richest Nation Became the Most Indebted? Economics AltSimplified, Oct 4, 2020. Who lends the money? 30% of debt is foreign. Japan and China hold over 1 trillion; they are heavily reliant on exports; they make the dollar more expensive relative to their own currencies — demand which is backed up by US’s role as the default world currency and a military power. It allows the US to borrow money at lower interest rates. Explores future projections, the debt ceiling, domestic politics, the “Laffer Curve” (which has been criticized for its veracity), aging population.

Charlene Crowell, COVID Worsens Debt Harassment. Bay State Banner, Nov 11, 2020. “On Oct. 30, the Consumer Financial Protection Bureau (CFPB) released its 653-page regulatory revision for enforcement of the Fair Debt Collection Practices Act (FDCPA), originally enacted in 1977. Since that time, the debt collection industry has grown into a multi-billion industry with over 8,000 firms throughout the country… The largest portion of debt in communities of color are for medical services and student loans… In addition, the CFPB’s own 2017 survey found that 44% of borrowers of color reported having been contacted about a debt, compared to 29% of white respondents. Even when accounting for differences in income, communities of color are disproportionately sued by debt collectors. In fact, 45% of borrowers living in communities of color faced litigation, while only 27% of similarly situated consumers in white areas were sued.”

Joeri Schasfoort, Why Private Bank Money Creation is Dangerous. Money & Macro, Jan 27, 2021. Why asset bubbles and financial cycles have positive feedback loops, like in the U.S. financial crisis. Banks lend, and want collateral, which mean that they make asset bubbles and financial cycles worse. What is “rational” from the individual person and individual bank perspective damage the system. Banks create a positive feedback loop between asset markets and bank lending. During the upswing, the asset valuation increases. But during the downswing, we are all unfortunate because people spend less when they need to repay loans, and banks go bankrupt.

New Economic Thinking, The Debt We Don't Talk About. New Economic Thinking, Mar 28, 2018. Private household and corporate debt.

Richard Best, Why Bank Bail-Ins Will Be the New Bailouts. Investopedia, August 31, 2021. “Financial reforms ushered in with the Dodd-Frank Act eliminated bailouts and opened the door for bail-ins. Bail-ins allow banks to convert debt into equity to increase their capital requirements. They shift the risk to unsecured creditors, including depositors whose account balances exceed the FDIC limit of $250,000. You can avoid bail-ins by spreading your assets across different banks and by monitoring changes in financial regulations.”

Gravel Institute, Why Credit Scores Are a Scam. Gravel Institute, Dec 9, 2021. Credit card companies plan to rake in profits from poor people who struggle to keep up their payments.

PBS Frontline, The Secret History of the Credit Card. PBS Frontline, Dec 14, 2021. A 55 minute documentary video. PBS and NYTimes show how the credit card industry became pervasive, lucrative, and politically powerful. (Aired 2004)

MHFIN, Ray Dalio Predicts Terrifying Financial Crisis. MHFIN, Dec 27, 2021. Billionaire investor Ray Dalio, CEO of Bridgestone, sees trouble coming. The monetization of debt and printing of more money, combined with deep political tensions, lead to a death spiral.

Olivia Rockeman, Consumer Debt in U.S. Surges by a Record $40 Billion. Bloomberg, Jan 7, 2022. “The figures suggest Americans’ are starting to rely more on credit as savings built up on the back of government pandemic-relief funding dries up. Bloomberg Economics estimates that households earning less than $90,000 a year will have exhausted their financial cushions by February.”

Joseph Brown, Arizona’s Bill to Make Bitcoin Legal Tender is Unconstitutional. Heresy Financial, Jan 31, 2022. But why is the dollar legal tender? Brown gives a historical and constitutional explanation. Even though the Constitution specifies gold and silver, we violate it with paper money once FDR made that change.

Joseph Brown, Mortgage Applications Are Dropping Like a Rock. Heresy Financial, Feb 9, 2022. Brown doesn’t look at cities or regions, but does look at broad economic and Fed data. His research is a helpful model.

CNBC, Why Microsoft Is Investing In Black-Owned Banks. CNBC, Mar 3, 2022. Multiple companies are making investments in black-owned banks. CNBC provides historical perspective on the loss of capital wealth and assets in the black community, as well as the decline of black-owned banks due to the consolidation of banks in general.

Krystal Ball and Saagar Enjeti, Archegos Fund Collapse Reveals Fakery Of Wall Street. Rising | The Hill, Apr 9, 2021. Viacom/CBS did not change in its underlying value, but all the layered debt traders who traded debt on top of its stock price created a collapse in margin calls. Saagar says, “This is financialization and globalization run amok. You have this guy who has a $10 billion fund. He borrows a bunch of money to buy Viacom stock, which was worth $20 billion. Because the stock is mostly held by borrowed money, if it goes down, he has to pay back all of his loans… It’s all fakery. The problem is that we borrow and leverage real things, like factories, and people’s jobs, and people’s pensions, and people’s homes, against the values of fake assets. And it causes huge blow-ups.”

China Insights, Beijing's Dilemma: Sri Lanka Owes $6+ Billion in Debt. What Happens If It Can’t Make the Payments? China Insights, Apr 12, 2022.

Kings and Generals, Fugger - Banker Who Brought the Habsburgs to Power. Kings and Generals, Apr 29, 2021. Jakob Fugger was the most wealthy man in the world at that time, and funded imperial projects. He persuaded the Medici Pope Clement VIII to change the church’s teaching on usury.

Richard Wolff, Ten Years Ago: European Debt Crisis. Democracy at Work, Jun 26, 2021.

Joseph Brown, Janet Yellen Warns Congress of ‘Catastrophic’ Debt Default. Heresy Financial, Jul 9, 2021. Discusses an unlikely scenario politically, but it’s useful to think about and acknowledge, that debt is a political and not simply economic issue.

Joseph Brown, The Biggest Deleveraging in History is Coming - And It Can't Be Stopped. Heresy Financial, Sep 29, 2021. “A great deleveraging is inevitable. Many are arguing about whether the possibility of inflation or deflation is more likely. The problem is, you get the deleveraging either way. And the deleveraging is the painful part. The individual winners and losers may change, but overall, the economy still MUST pay back the purchasing power that was already used in the past.”

Michael Cowan, Evergrande Exposed A Problem 10X Worse! | Chinas Housing Bubble. Michael Cowan channel, Sep 30, 2021. Highlights the interaction between private debt and municipal public debt to create an immense systemic problem in China and perhaps globally.

The Hill, Rep. Torres: Failing to Raise Debt Limit Increases Interest Rates. The Hill, Oct 1, 2021. Affirms that the US is able to spread out its inflation globally because the US dollar is the world’s default currency.

Bloomberg Surveillance, Nouriel Roubini Sees Global Debt Trap Driving Inflation. Bloomberg Markets and Finance, Sep 21, 2021. Surveys both public and private debt, and sees inflation as the only likely way to resolve the indebtedness.

Oscar Perry Abello, The Latest in Banking Reform for the People. The Bottom Line, Oct 12, 2021. Highlights a list of legislative policy proposals.

James Kynge and Sun Yu, Is China’s Economic Model Broken? Financial Times, Oct 15, 2021. Highlights how debt-driven housing speculation contributes to why China’s housing market is close to 30% of its GDP, unlike other nations. President Xi Jin-Ping’s administration drew three red lines, dealing with debt, because Xi said, “Housing is for living, not for speculating.” See also Lei’s Real Talk, China’s Real Estate Bubble Explained and Compared to Japan’s Real Estate Crisis 1990s. Lei’s Real Talk, Oct 8, 2021. Gives a helpful comparison to low-interest monetary policy in Japan. China Insights, How Come Fantasia Can’t Repay $206 Million Offshore Bond with 4.7 Billion in Hand? China Insights, Oct 18, 2021. Explains why Chinese real estate firms will appease the Chinese Communist Party and break debt repayment commitments to Wall Street. Wall Street’s debt-fueled greed is likely to get burned.

Francesca Newton, Why You’re Watching Squid Game. Jacobin Magazine, Oct 21, 2021. Indebtedness and capitalist realism.

Thom Hartmann, Why Financialization Damages America (w/ Prof. Richard Wolff) Thom Hartmann Program, Nov 17, 2021. Explores the history of credit-debt practices and the intertwining of people, institutions, and governments via debt.

Yanis Varoufakis, Looming Threats in the Global Economy? The Agenda with Steve Paikin, April 21, 2022. Varoufakis notes:

“With the benefit of hindsight, the West should be self-critical… Let me remind you that after 1991, Russia was on its knees. You had Yeltsin. You had, in the prime-minister-ship of Russia, liberal reformists. Why were they crushed? They were crushed because the International monetary Fund and Washington insisted on a policy of exacting a pound of flesh from the Russian economy in the form of debt repayments that the Russian economy was simply not prepared to make. Let me remind you that between 1995 and 1998, Russia was pushed into a major financial crisis by the West. The IMF brought Russia to its knees in 1998. Let me remind you that because of this policy by the International Monetary Fund and Washington, the life expectancy of men in Russia fell from 78 to 56 years of age. This has never happened, in any country in the world, in such a short space of time to have this crushing effect on an economy, a society. It is my considered opinion that the monster that goes by the name Vladimir Putin was bred in the guts of this gigantic humiliation of the Russian people. That was effected by the denial to the Russian people of the opportunity to join the global economy. It is time that Washington takes a very good look at itself in the mirror and understand that it’s not that integrating the Russian economy didn’t work. It was a choice of Washington and in particular the International Monetary Fund in association with Washington DC. It was a choice not to integrate Russia that gave rise to Putin, the oligarchs, and gave the impetus to a process by which Russia became the villain of the piece.” “I have a message for my good friends in Washington DC at the International Monetary Fund. If you really care about Ukraine, put your money where your mouth is. Stop extracting — as we speak — billions of dollars in interest payments from Ukraine’s public debt: debt to the IMF. The IMF should restructure, should haircut, should write down the debt of Ukraine instead of insisting on exacting pounds of flesh from the state of Ukraine while the people of Ukraine are struggling to survive. Let’s end this hypocrisy.”

Joseph Brown, Fed Warns Commodities Pose “Macroeconomic Risk”. Heresy Financial, Apr 21, 2022. A helpful explainer about how the interest rate fluctuations themselves create debt-traps, especially with commodities.

Selam Gebrekidan, Matt Apuzzo, Catherine Porter and Constant Méheut, Invade Haiti,Wall Street Urged.The U.S. Obliged. New York Times, May 20, 2022.

David Wengrow, A New Understanding of Human History and the Roots of Inequality. TED, July 26, 2022. An 18 minute video. Archaeologist David Wengrow and anthropologist David Graber point out that ancient societies demonstrated remarkable political and social flexibility at times – flexibility that we can recover in relations of power, especially indebtedness. Thus, we are not trapped in inequalities brought on by agricultural settlement and cities, because the ancients were not, either. See also interview by Amy Goodman, “The Dawn of Everything”: David Wengrow & the Late David Graeber On a New History of Humanity. Democracy Now, November 18, 2021. A 21 minute video interview. “In an extended interview, we speak with archeologist David Wengrow, who co-authored the new book “The Dawn of Everything: A New History of Humanity” with the late anthropologist David Graeber. The book examines how Indigenous cultures contributed greatly to what we have come to understand as so-called Western ideas of democracy and equality, but argues these contributions have been erased from history. “What the broad sweep of history shows is that living in large-scale, densely populated, technologically sophisticated societies really doesn’t require people to simply give up social freedoms,” says Wengrow.”

Amy Goodman and Juan Gonzalez, Economist Jayati Ghosh: Global Debt Crisis Is Perfect Storm of Unrest, Economic Disaster, Starvation. Democracy Now, Jul 27, 2022. One-third of India's population is now eating a starvation level diet. Fully 72 percent of the country is unable to afford a nutritious diet. Matters are worse in Sri Lanka and other countries. Private Wall Street banks and financiers are responsible for much of the debt hanging over Sri Lanka and other developing world countries. China is only responsible for 10 percent of it, even though China is often blamed. Yet governments are not pressing for private debt restructuring. Instead, the Federal Reserve raises interest rates which makes the US dollar more expensive, which makes other countries pay more in order to repay their debt. Ancient Jews, Greeks, Christians, and Muslims all recognized that debt needs to be periodically forgiven (Lev.25; Deut.15), and debt based on interest rate lending is exploitation. According to historians of the Ancient Near East, "jubilees" of debt forgiveness happened periodically, though none quite as often or extensively as the Jubilee Year of Israel in Leviticus 25. But our modern day capitalist culture does not recognize that exploitation on the premise that people take loans or go into debt “voluntarily” and without coercion. Prioritizing restorative justice means taking a very critical look at relationships of indebtedness because interest-bearing debt itself is a form of exploitation, and the relationship needs to be rebalanced in order to be restored.

Joeri Schasfoort, The Global Debt Mountain. Money & Macro, Aug 30, 2022. A 54 minute video. Schasfoort interviews economist Dirk Bezemer, and both argue that total debt (private and public) is so far above GDP globally, that the entire system is fragile.

Joseph Brown, Credit Card Debt is about to Wipe Out Most Americans. Heresy Financial, Oct 3, 2022.

Clara E. Mattei, The Capital Order: How Economists Invented Austerity and Paved the Way to Fascism. University of Chicago Press | Amazon page, Nov 2022. See interview Clara Mattei, How Economists Invented Austerity & Paved the Way to Fascism. Institute for New Economic Thinking, Oct 12, 2022. A 15 minute video.

Saagar Enjeti, Saagar Loses Thousands In Blockfi Bankruptcy. Breaking Points with Krystal and Saagar, Nov 29, 2022. Highlights why banking as an entire industry needed to be regulated with capital controls prior to the Great Depression.

Joseph Brown, There is $80 Trillion in Missing Dollar Debt. Heresy Financial, Dec 7, 2022. The Fed doesn’t know where this debt actually is, what currency it is in, etc.

Krystal Ball and Saagar Enjeti, Sam Bankman-Fried Indictment: Everything You Need To Know. Breaking Points with Krystal Ball and Saagar Enjeti, Dec 13, 2022. One of the most extreme examples of debt-funded fraud. It’s worth exploring why debt can serve as a financial instrument in this way.

Financial Times, Fractured Markets: The Big Threats to the Financial System. Financial Times, Dec 19, 2022.

Mac Schwerin, The ‘Buy Now, Pay Later’ Bubble Is About to Burst. The Atlantic, Jan 10, 2023. “Many Gen Zers have rejected traditional credit in favor of new-age layaway programs, which are riskier than they may seem.”

Economics Explained Essentials, The Greek Debt Crisis Explained. Economics Explained Essentials, Jan 24, 2023.

Krystal Ball, Revealed: Why Southerners' Credit Scores Are Terrible. Breaking Points, Feb 23, 2023. Medical debt due to Southern political leaders refusing to expand Medicaid under the Affordable Care Act 2010. Refers to Andrew Van Dam, Why the South Has Such Low Credit Scores. Washington Post, Feb 17, 2023.

Joseph Brown, The Biggest Deleveraging in History has Just Begun. Heresy Financial, Mar 20, 2023. Leveraging means taking on debt by pulling purchasing power from the future into the present. Deleveraging means paying back debt through austerity.

Yves Smith, Origins of Debt: Michael Hudson Reveals How Financial Oligarchies in Greece and Rome Shaped Our World. Naked Capitalism, May 27, 2023. An illuminating overview of history, including Jewish law and Jubilee.

Robert Benincasa and Nick McMillan, Many People Living in the ‘Diabetes Belt’ Are Plagued With Medical Debt. Kaiser Family Foundation, May 30, 2023.

Krystal Ball and Saagar Enjeti, Credit Card Debt Tops 1 Trillion Crushing Young Americans. Breaking Points, Aug 10, 2023.

Akela Lacy, Payday Lenders Gave Millions to Republican Group That Backed Supreme Court Suit to Annihilate CFPB. The Intercept, Aug 30, 2023. “The Republican Attorneys General Association fought to help a Supreme Court case against the Consumer Finance Protection Bureau.”

Jeff Jacoby, The Wonderful Life of ‘It’s a Wonderful Life’. Boston Globe, Dec 24, 2023. “In Frank Capra’s beloved film, numerous characters, and even a house, get a second chance.” The film earned notable enemies who were pro-banking.

Coby Lefkowitz, Why Small Developers Are Getting Squeezed Out of the Housing Market. Noahpinion | Substack, Mar 1, 2024. Why small developers are getting squeezed out of the housing market: The use of debt leveraging by housing developers.

Ben Casselman and Jeanna Smialek, High Interest Rates Are Hitting Poorer Americans the Hardest. New York Times, May 14, 2024. “For poorer families, it is different. They are likelier to carry a balance on credit cards, meaning they’re more likely to feel high rates…. Fed data suggests that wealth for the upper half dipped after the Fed’s initial rate increase in 2022, but is again setting records. For the bottom half, however, wealth remains below its level before the Fed began raising rates, after subtracting credit card and mortgage debt and other liabilities.”

Ana Kasparian, What Really Killed Red Lobster. The Young Turks, May 20, 2024. Highlights private equity ownership and consolidation of upstream markets into monopolistic suppliers.

More Perfect Union, What Capital One Doesn’t Want You to Know. More Perfect Union, May 24, 2024. “America has a credit card cartel—and it's about to get bigger. Capital One and Discover want to merge into the largest credit card company in the U.S. Swipe fees and interest rates will rise even higher, and banks will make billions. This merger must be stopped.”

CNBC, How Phantom Debt Is Haunting American Consumers. CNBC, Jun 24, 2024. The number of buy now, pay later loans increased nearly 1,100% between 2019 and 2021, according to data compiled by the Consumer Financial Protection Bureau. The debt that accumulates from these loans is referred to as "phantom debt," because it's unclear just how much is out there and how well consumers are paying them back. Juniper Research estimates these transactions could reach nearly $700 billion by 2028. Watch the video above to learn more about the risk phantom debt poses to the economy.

Joeri Schaasfort, Economist Explains Why India Can Never Grow Like China. Money & Macro, Jun 27, 2024. Schaasfort argues, first, Foreign Direct Investment created an abundance of available capital for business investment. Also, second, the caste system interfered with local business and government hiring practices. Third, China’s centralized state performed favorably with India’s precocious democracy where people, especially public officials, made short-term decisions.

Radhika Desai and Michael Hudson, Debt Is Political: Why Wealth Flows from Poor to Rich. Geopolitical Economy Report, Aug 4, 2024. An outstanding discussion about debt on the international level. The U.S. appears to have pressured lenders to support Ukraine, perhaps assuring them that Ukraine’s mineral and gas-oil resources will be for sale after the Russian-Ukrainian War. Desai and Hudson comment on the history of how debt and war are intertwined.

Second Thought, Why Housing Keeps Getting More Expensive. Second Thought, Oct 4, 2024. It’s not a simple supply and demand equation. House prices go up mostly with the availability of finance, not housing. It is influenced by government policies since the 1980s, the global finance market, and the generational wealth gap. Homebuyers went into debt to banks, then banks could bet on mortgage debt via securitization. Perhaps tenants’ unions, tenant strikes, and social housing would help.

Strong Towns, This Town is Confronting Suburbia's Debt Trap. Strong Towns, Nov 1, 2024. Maumee, our 9th Strongest Town winner, is now struggling with the cost of repairing its water infrastructure. Meanwhile, most U.S. cities and towns are insolvent financially for similar reasons. According to Truth in Accounting, 53 of the 75 of the most populous U.S. cities are insolvent. We need federal limits or even bans on municipal debt ability, because that would force cities to levy taxes on the rich, and prevent the rich from being able to move away to another city with lower taxes. See also CNBC, Why 27 States Are Going Broke. CNBC, Nov 4, 2024. States owe pensions as debt, and 27 states are struggling to pay those bills.

Christian Restorative Justice, Banking, and Finance: Topics:

This page is part of our section on Banks and Finance, which examines the following topics: Interest Rate Lending critiques usury from multiple vantage points including the biblical, and highlights moral and economic problems associated with it. Debt Forgiveness explores the rationales and effects of forgiving debts. Corruption and Regulation demonstrates how nefarious banks and financial institutions are. Central Banks explores currency manipulation and monetary policy. Public Banks explore options like a public option for banks, postal banking, and actual examples of socialized banks. Islamic Banking examines quranic principles and examples of a different institutional framework for banking. Student Loan Debt tracks the challenges and root causes behind ballooning student loan debt in the U.S. See also Racism in Banking and Finance for resources on racism and finance.

Christian Restorative Justice Critique of the Right: Domestic Policy Topics:

This page is part of our section Critique of the Right, which engages the following topics: Banking and Finance examines the economic and political power of financial institutions; Bioethics discusses abortion policy; Business and Economics examines economic theories, taxes, housing, environment, corporate law, labor law, automation, and inequalities of wealth and power; Civil Unions makes the Christian case for civil unions for all and removing marriage from the culture wars; Criminal Justice examines crime statistics and definition, policing, prosecution, sentencing, prisons, and reintegration; Education examines public education and conservative resistance to it; Environment and Health highlights the many challenges we face related to animals, climate change, food, and health systems; Government Corruption spotlights political compromises and dealings contrary to the public good; Gun Rights examines gun policies and rhetoric; Media spotlights failures of, and possible fixes to, left-wing or left-leaning media; Power and Politics highlights the impact of racial considerations and racism on political campaigns, voting rights, public investments, and other political procedures; Race examines the impact of white supremacy on virtually every aspect of American life.

Christian Restorative Justice Critique of the Right: Philosophical Influences

Desire: Topics:

Here’s how to understand this section on Desire: We believe Jesus’ own human desires, journey, and teaching are normative for human becoming, so we pursue Christian Spiritual and Emotional Formation to help us better understand pastoral, relational, and communal questions that come up as we pursue Jesus’ vision for human flourishing. We stay aware of research and reflections on Human Moral and Emotional Development. Many insights into the mind-brain-body connection in Neuroscience and Epigenetics and Sleep and Rest are helpful. We follow research on Friendship and Happiness, track resources about Greed and How Money Makes Us More Greedy, point out in Consumption how capitalist overconsumption and addiction challenge the notion that we are “sovereign individuals,” maintain the biblical critique of Interest Rate Lending and Debt as a way people fund overconsumption and entrap themselves, reflect on Sex as part of human moral and emotional development; we critique the Sex Industry for how it distorts us. Human Destiny itself can be understood through the lens of desire.