Financial Corruption and Regulation

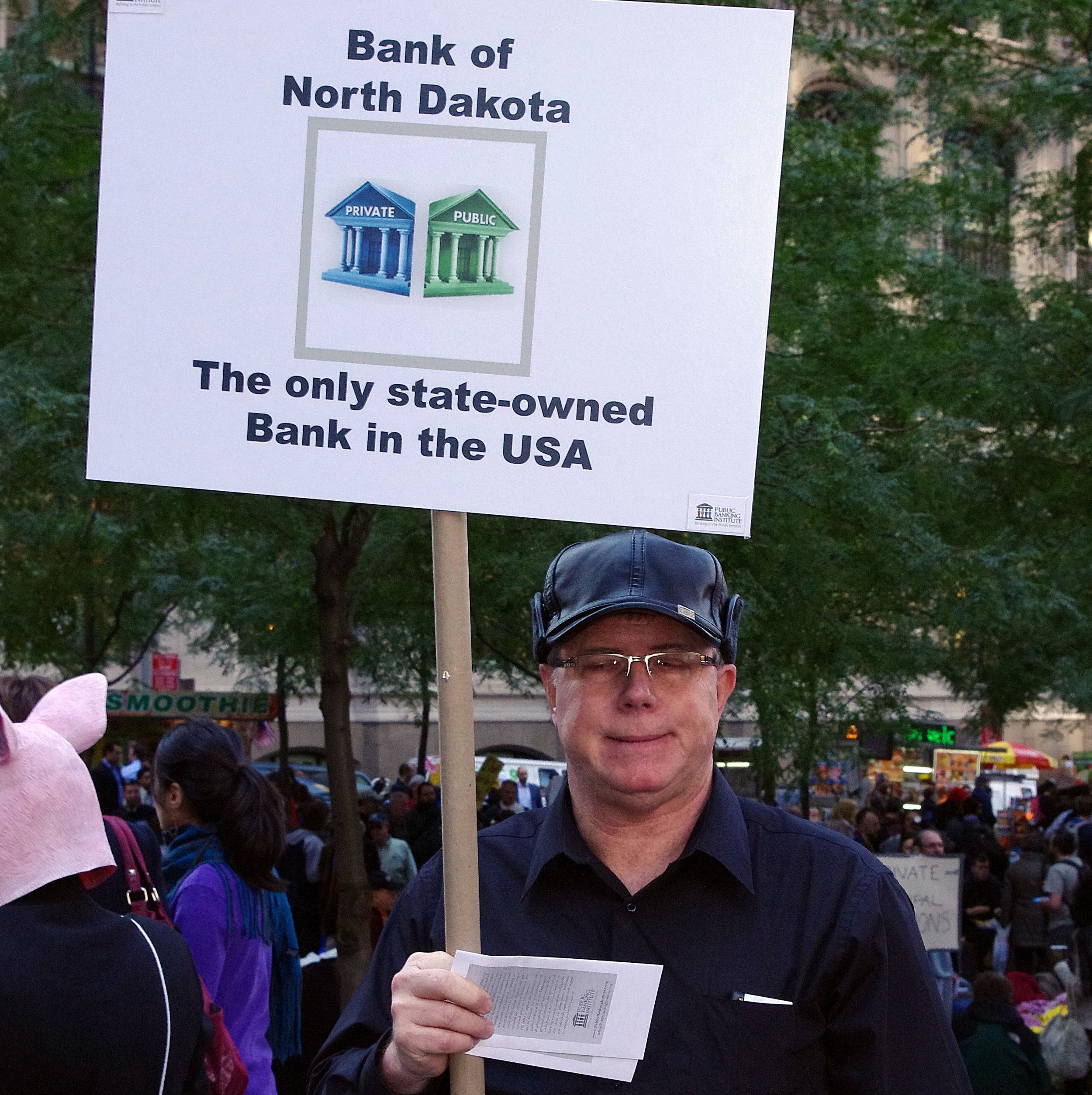

Photo credit: Elmago Delmar | CC2.0.

This page demonstrates how nefarious banks and financial institutions are, along with why and what kind of regulation might be effective regulation.

Other Resources on Financial Corruption and Regulation

Money Laundering (website)

Global Witness, Stopping the Financial Sector Fuelling Corruption (website)

Global Financial Integrity (website)

Financial Transparency Coalition (website)

Transparency International (website)

Tax Justice Network (website)

Noam Chomsky, Free Markets? Santarchy, Dec 5, 1997. About the role of the state in markets and economic development; the importance of limiting capital and banks.

John Eatwell, Lance Taylor, Global Finance at Risk: The Case for International Regulation. The New Press | Amazon, Feb 2001.

Brad M. Barber and Terrance Owen, Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment. Quarterly Journal of Economic, Feb 2001. See also R.A., Boys Will Be Boys. Economist, Sep 21, 2010.

Raymond Baker, Capitalism's Achilles Heel: Dirty Money and How to Renew the Free Market System. Wiley | Amazon page, Aug 2005.

The Inside Job, a documentary about the financial industry and the economic collapse of 2008.

Carter Dougherty, Stopping a Financial Crisis, the Swedish Way. NY Times, Sep 22, 2008.

Amy Goodman, Noam Chomsky on the Global Economic Crisis, Healthcare, US Foreign Policy and Resistance to American Empire. Democracy Now, Apr 13, 2009.

John C. Courtney and Pietro S. Nivola, Know Thy Neighbor: What Canada Can Tell Us About Financial Regulation. Brookings Institute, Apr 23, 2009.

BBC News, Market Crisis 'Will Happen Again' BBC News, Sep 8, 2009. An interview of Alan Greenspan, who blames human nature

David Halbfinger, 44 Charged by U.S. in New Jersey Corruption Sweep. New York Times, Jul 23, 2009. Includes 3 mayors and 5 rabbis.

Andrew Tavani, Inside The Mind of Madoff: NYT's Diana Henriques Discusses New Book 'Wizard Of Lies'. Huffington Post, Apr 26, 2011.

David Graeber, Debt: The First 5,000 Years. Melville House | Amazon page, 2012. (pdf book). See also review by Phil Ebersole, David Graeber on Debt as a False Religion. blog, Sep 9, 2013. See also some commentary by John Green's 15 minute summary Money & Debt. Crash Course video, Jul 2014.

Jake Halpern, Iceland's Big Thaw. New York Times, May 13, 2011.

Vedran Vuk, Are There Too Many Smart People in the Financial Industry? Financial Sense, Jan 27, 2011.

Noam Chomsky and Glenn Greenwald, How the Law is Used to Destroy Equality and Protect the Powerful. CSpan video, Oct 29, 2011.

Greg Palast, How U.S. Vulture Funds Make Millions by Exploiting African Nations. Democracy Now, Nov 22, 2011.

Kevin Roose, A Raucous Hazing at a Wall St. Fraternity. New York Times, Jan 20, 2012.

Robert Shiller, Finance and the Common Good. Princeton University Press | Amazon page, Mar 2012.

Greg Smith, Why I Am Leaving Goldman Sachs. New York Times op-ed, Mar 14, 2012.

Laura Ackerman and Don Bustos, Disadvantaged Farmers: Addressing Inequalities in Federal Programs for Farmers of Color. Institute for Agriculture and Trade Policy, Mar 28, 2012.

David Rhode, The Libor Scandal and Capitalism's Moral Decay. The Atlantic, Jul 13, 2012.

Jaromir Benes and Michael Kumhof, The Chicago Plan Revisited. IMF Working Paper, Aug 2012.

David Stockman, Mitt Romney: The Great Deformer. Newsweek, Oct 14, 2012.

Greg Palast, Mitt Romney's Bailout Bonanza: How He Made Millions from the Rescue of Detroit. Democracy Now, Oct 18, 2012.

Frank Partnoy and Jesse Eisenger, What's Inside America's Banks? The Atlantic, Jan-Feb 2013.

Michael Lewis, The Trouble With Wall Street: The Shocking News that Goldman Sachs is Greedy. New Republic, Feb 4, 2013.

Richard Sylla, The Art of Banking Since the Medici. FORA.tv video, Mar 1, 2013.

Matthew C. Klein, The Best Way to Save Banking is to Kill It. Bloomberg, Mar 27, 2013.

Joshua Davis, Meet the Man Who Sold His Fate to Investors at $1 a Share. Wired, Mar 28, 2013. Raises deep questions about both corporate personhood and the morality of investors.

Jeffrey Sachs, Fractional Reserve Banking and Fraud. Fixing the Financial System for Good Conference, Apr 17, 2013. Why we should stop fractional reserve banking.

David Knowles, Bank of America Ordered to Pay $2.2 Million to 1,000 Black Job Seekers It Discriminated Against. New York Daily News, Sep 23, 2013.

Robert Shiller, Should We Worry About 'Unproductive' Financial Sector Gobbling Up Our Best? UK Guardian, Sep 23, 2013.

Laura Gottsdiener, How Wall Street Has Turned Housing Into a Dangerous Get-Rich-Quick Scheme - Again. Huffington Post, Nov 26, 2013.

Amy Goodman and Nermeen Shaikh, Reverend Billy Faces Year in Prison for Protesting JP Morgan Chase's Financing of Fossil Fuels. Democracy Now, Truthout, Nov 27, 2013.

Samantha Bee, Blackstone and Codere. The Daily Show, Dec 4, 2013.

Matt Levine, Blackstone Made Money on Credit-Default Swaps With This One Weird Trick. Bloomberg, Dec 5, 2013.

Matt Taibbi, Outrageous HSBC Settlement Proves the Drug War is a Joke. Rolling Stone, Dec 13, 2013.

James Howard Kunstler, The Volcker Rule Is a Maddening Case Study in How to Suffocate Wall Street Reform. Huffington Post, Dec 17, 2013.

Stephen Perlberg, We Saw "Wolf of Wall Street" With a Bunch of Wall Street Dudes and It Was Disturbing. Business Insider, Dec 19, 2013.

Christina McDowell, An Open Letter to the Makers of The Wolf of Wall Street, and the Wolf Himself. Los Angeles Weekly, Dec 26, 2013.

Yanis Varoufakis, Bitcoin and the Dangerous Fantasy of 'Apolitical' Money. Truthdig, Dec 26, 2013.

David Kocieniewski, Academics Who Defend Wall Street Reap Reward. New York Times, Dec 27, 2013.

Jonathan Coppage, Big Banks Score a Win in Switzerland. The American Conservative, Jan 15, 2014.

Consumer Financial Protections Bureau, CFPB Supervision Report Highlights Mortgage Servicing Problems in 2013. CFPB, Jan 30, 2014.

Stephanie Gibaud, The Woman Who Really Knew Too Much. Cherche Midi | Amazon page, Feb 2014. And Stephanie Gibaud, Whistleblowers: The Man Hunt. Max Milo | Amazon page, Oct 2017. Chris Hedges, Interview with Stephanie Gibaud. The Chris Hedges Report, Oct 12, 2023. on the billions of dollars in fraud orchestrated by international banks and how those who expose it are persecuted and blacklisted.

Steven Perlberg, The Top Currency Traders At Goldman Sachs And Citi Are Reportedly Leaving. Business Insider, Feb 5, 2014.

Kevin Roose, Revealed: The Full Membership List of Wall Street’s Secret Society. New York Magazine, Feb 18, 2014.

Kevin Roose, One-Percent Jokes and Plutocrats in Drag: What I Saw When I Crashed a Wall Street Secret Society. New York Magazine, Feb 18, 2014.

Daniel Wager, Debt Collectors Go After Service Members Despite Protections. The Center for Public Integrity, Mar 11, 2014. note the CFPB's role

"Tyler Durden", The Holy Grail of Investing Has Been Found: HFT Firm Reveals 1 Losing Trading Day of 1238 Days of Trading. Zero Hedge blog, Mar 10, 2014.

Michael McLeay, et.al., Money Creation in the Modern Economy. Bank of England Quarterly, Q1 2014.

Chris Arnade, The Pope, Obama, and a Former Banker Walk Into a Slum: Does the 1% Still Win? The Guardian UK, Mar 27, 2014.

Joe Nocera, Michael Lewis' Crusade. New York Times, Apr 4, 2014.

The Economist, The Slumps That Shaped Modern Finance. The Economist, Apr 2014.

Simon Johnson, The End of Our Financial Illusions. New York Times, Apr 17, 2014. How innovation in finance is bad, unlike innovation in technology

Nomi Prins, All the Presidents' Bankers: The Hidden Alliances That Drive American Power. Nation Books | Amazon page, 2014.

Jeff Leinaweaver, How UC Berkeley MBA's Beat the Market with a Socially Responsible Fund. The Guardian, Apr 17, 2014.

Joe Weisenthal, Everyone Should Read This Explanation of Where Money Comes From. Business Insider, Apr 27, 2014.

Joe Weisenthal, People Are Seriously Talking About Banning the Banks - And Its Not As Crazy As It Sounds. Business Insider, Apr 27, 2014.

Ian Katz, Geithner in Book Says U.S. Considered Nationalizing Banks. Bloomberg Business, May 8, 2014.

Richard Eskow, Look Out, Wall Street, the New Populism is Coming. Huffington Post, May 13, 2014.

Richard D. Wolff, Economic Update: Yet More Big Bank Misdeeds. Truthout, May 15, 2014.

James Pethokoukis, Was Not Massively Helping Underwater Homeowners a Massive Mistake? AEI, May 20, 2014.

Erika Eichelberger, America's 10 Most Hated Banks. Mother Jones, Jul 29, 2014.

Paul Krugman, Obama's Other Success: Dodd-Frank Financial Reform is Working. New York Times, Aug 3, 2014.

WBEZ, The Secret Recordings of Carmen Zegarra. This American Life, Sep 26, 2014.

Jake Bernstein, Inside the New York Fed: Secret Recordings and a Culture Clash. ProPublica, Sep 26, 2014.

Dina Spector, MICHAEL LEWIS: The 'Ray Rice Video' Of Wall Street Has Arrived. Business Insider, Sep 26, 2014.

Matt Taibbi, The $9 Billion Witness: Meet JPMorgan Chase's Worst Nightmare. Rolling Stone, Nov 6, 2014.

Bethany McLean, A House is Not a Credit Card. NY Times, Nov 13, 2014.

Peter Eavis, New York Fed Is Criticized on Oversight. New York Times, Nov 21, 2014.

Robert Reich, Wall Street's Democrats. Huffington Post, Dec 8, 2014.

Elizabeth Warren, Remarks on Citigroup and Its Bailout Provision. Senator Elizabeth Warren, Dec 12, 2014.

David Frum, The Real Story of How America Became an Economic Superpower. The Atlantic, Dec 24, 2014.

Sean McElwee and Lenore Palladino, Why is the Financial Industry So Afraid of This Man? Joseph Stiglitz. Why Has He Apparently Been Blacklisted by Regulators? Salon, Jan 11, 2015.

Jody Shem, Subprime Bonds Are Back With Different Name Seven Year After U.S. Crisis. Bloomberg, Jan 27, 2015.

Catherine C. Eckel and Sasha C. Fullbrunn, Thar SHE Blows? Gender, Competition, and Bubbles in Experimental Asset Markets. American Economic Review, Feb 2015.

Buttonwood, Warning: Too Much Finance Is Bad for the Economy. Economist, Feb 18, 2015.

Ben Hallman, World Bank Admits It Ignored Its Own Rules Designed To Protect The Poor. Huffington Post, Mar 5, 2015.

CNN News, What an Interest Rate Increase Means for Real People. CNN News, Mar 19, 2015.

Zach Carter, General Electric Hands Dodd-Frank Its Biggest Victory Yet. Huffington Post, Apr 10, 2015.

Noah Smith, Finding the Value in Finance. Bloomberg, Apr 16, 2015.

William D. Cohen, Can Bankers Behave? The Atlantic, May 2015.

Elisabeth Parker, Surprise! New Study Finds Wall Street is as Greedy and Immoral As Ever. Addicting Info, May 19, 2015.

Andrew Ross Sorkin, Many on Wall Street Say It Remains Untamed. New York Times, May 19, 2015.

NY Times Editorial Board, Banks as Felons, or Criminality Lite. New York Times, May 22, 2015.

Suzy Hansen, A Finance Minister Fit for a Greek Tragedy? New York Times, May 24, 2015.

NY Times Editorial Board, Racial Penalties in Baltimore Mortgages. New York Times, May 30, 2015.

Elliot Blair Smith, How J.P. Morgan and Barclays Mistakes Inflated the Housing Bubble. Marketwatch, Jun 4, 2015.

Lee Fang, Eric Holder Returns as Hero to Law Firm That Lobbies for Big Banks. Intercept, Jul 6, 2015.

Richard Rothstein, America’s Big Race Lie: How Big Banks and Racist Policies Helped Shape Segregation, Police Brutality. Salon, Jun 17, 2015.

Brandon Wenerd, Goldman Sachs Is Asking Summer Interns to Only Work 17 Hours a Day Moving Forward. BrosBible, Jun 17, 2015.

Cenk Uygur, TPP Grants Banks Terrifying Secret Powers. The Young Turks, Jun 20, 2015.

Zach Carter, Elizabeth Warren Nails GOP Financial Exec: Retiree Lawsuits Undermine Attack on New Obama Rule. Huffington Post, Jul 21, 2015.

Alice Ollstein, Bankers Are Buying Baltimore's Debt, Charging Families Crazy Interest Rates, Then Taking Their Homes. Think Progress, Aug 25, 2015.

Mike Konczal, Critics Say Hillary Clinton is Pro-Wall Street. Her Wall Street Reform Plan Says Otherwise. Vox, Oct 8, 2015.

Matthew Yglesias, Hillary Clinton's Plan to Tame Big Banks Shows Her at Her Wonkish Best. Vox, Oct 9, 2015.

James Woods, Iceland Sentences 26 Bankers to a Combined 74 Years in Prison. US Uncut, Oct 21, 2015.

Shane White, The Story of Wall Street's First Black Millionaire. The Atlantic, Oct 21, 2015.

Zach Carter, Elizabeth Warren Hits Wall Street to Defend Obama Retirement Rule. Huffington Post, Oct 27, 2015.

Claire Bernish, First They Jailed the Bankers, Now Every Icelander to Get Paid in Bank Sale. The Antimedia, Oct 29, 2015.

David Dayen, Wall Street Is Finally Getting Its Comeuppance: Why New Global Regulations Are a Vital Step in the Right Direction. Salon, Nov 10, 2015.

Ralph Nader, For America's Unbanked: Re-establishing the Postal Savings Bank. Huffington Post, Nov 13, 2015. Advocating Campaign for Postal Banking

Michael Pope, Car Title Loan Borrowers Should Be Wary Of Requirements. NPR, Nov 28, 2015.

Charles Mudede, What the Empty Storefronts in Vancouver, BC Tell Us About the Dangers of Global Capital. The Stranger blog, Dec 1, 2015.

Matthew Yglesias, Why Hillary Clinton Is Hitting Bernie Sanders from the Left on Bank Regulation. Vox, Jan 7, 2016. about shadow banks

Ryan Tracy, Christine Rexrode, and Emily Glazer, Forget Too Big to Fail; Too Expensive to Exist. Wall Street Journal, Jan 13, 2016. How regulation indirectly affects size.

Zach Carter, Here's Why Obama's New Wall Street Rule Is A Great Idea. Huffington Post, Jan 19, 2016. On retirement and investment advisors being bribed by financial companies to direct customers their way.

Leon H. Wolf, Donald Trump is Owned by Every Bank on Wall Street. Red State, Jan 22, 2016.

Willie Gable, Jr., Be Wary of. Loan) Sharks in Sheep's Clothing. Washington Post, Feb 17, 2016.

Zach Carter, Big Banks Aided Firm At Center Of International Bribery Scandal. Huffington Post, Apr 2, 2016. Unaoil and corrupt regimes

Peter Eavis, Living Wills of 5 Banks Fail to Pass Muster. NY Times, Apr 13, 2016.

Brian S. Feldman, How America's Coastal Cities Left the Heartland Behind. The Atlantic, Apr 18, 2016. About regulatory policy and banks.

Alana Semuels, Who Can Go After Banks for the Foreclosure Crisis? The Atlantic, May 3, 2016.

Patricia Hurtado & Michael Keller, How the Feds Pulled Off the Biggest Insider-Trading Investigation in U.S. History. Bloomberg, Jun 1, 2016.

Lynn Parramore, Can Philosophy Stop Bankers From Stealing? Institute for New Economic Thinking, Jun 7, 2016.

Renae Merle and Jonnelle Marte, Wall Street Is Making Big Bucks from Overdraft Fees – Again. Washington Post, Jun 13, 2016.

Rob Wile, The Co-Founder of America's Largest Black-Owned Bank Says Racism is Rampant in Finance. Splinter, Jul 28, 2016.

John Oliver, Panana Papers and Credit Reports. Last Week Tonight, Jul 31, 2016.

Robert Reich, A Little Goes a Long Way: Why a Small Tax on Wall Street Trades Is a Good Idea. Salon, Aug 11, 2016.

James Rufus Koren, Wells Fargo to Pay $185 million to Settle Allegations Its Workers Opened Fake Accounts. Los Angeles Times, Sep 8, 2016. See also Seth Myers, Dammit! Wells Fargo. Saturday Night Live, Sep 15, 2016. See also John Oliver, Wells Fargo. Last Week Tonight, Sep 26, 2016.

Bill Chappell, 'You Should Resign': Watch Sen. Elizabeth Warren Grill Wells Fargo CEO John Stumpf. NPR, Sep 20, 2016.

Silla Brush, Trump May Save Banks Billions by Disrupting Global Rules. Business Insider, Nov 13, 2016. A big problem esp re: assessments of risk on debt

Ryan Cooper, 2009: The Year the Democratic Party Died. The Week, Nov 15, 2016. How they handled the banking and mortgage crisis

Rebecca McCray, Meet the Six Big Banks Keeping Private Prisons in Business. Huffington Post, Nov 17, 2016.

David Dayen, Treasury Nominee Steve Mnuchin’s Bank Accused of “Widespread Misconduct” in Leaked Memo. The Intercept, Jan 3, 2017.

Gillian B. White, Two Major Credit Reporting Agencies Have Been Lying to Consumers. The Atlantic, Jan 4, 2017.

Mark Sumner, Donald Trump Was Bailed Out of Bankruptcy by Russia Crime Bosses. Alternet, Jan 10, 2017. A summary from an article in the Financial Times.

Liam Vaughan and Gavin Finch, Libor Scandal: The Bankers Who Fixed the World's Most Important Number. Guardian, Jan 18, 2017.

Stacy Cowley and Jessica Silver-Greenberg, Student Loan Collector Cheated Millions, Lawsuits Say. New York Times, Jan 18, 2017.

Mary Papenfuss, Wells Fargo Complaints Vanish From Labor Department Website. Huffington Post, Jan 27, 2017.

The Young Turks, Wells Fargo Loses Billions for Funding Dakota Pipeline. The Young Turks, Feb 5, 2017. Seattle pulled $3b out.

The Young Turks, Why Warren Buffett Loves Dakota Access Pipeline. The Young Turks, Feb 5, 2017. Example of Buffett's political activities protecting his investments.

Richard Werner, How the Banking System and Financial Sector Really Work. Alessandro Del Prete, Mar 9, 2017. GDP analysts don’t know how to account for the financial sector; their value-added is zero, even negative. Werner argues for decentralized, small banks.

Nathan Layne, Ned Parker, Svetlana Reiter, Stephen Grey and Ryan McNeil, Russian Elites Invested Nearly $100 Million in Trump Buildings. Business Insider, Mar 17, 2017.

Caleb Melby and David Kocieniewski, Inside the Troubled Kushner Tower: Empty Offices and Mounting Debt. Bloomberg, Mar 22, 2017.

Jeff Horwitz and Chad Day, Before Trump Job, Manafort Worked to Aid Putin. Associated Press News, Mar 23, 2017.

Daniel Mintz, Why Cut an Agency That Makes Money? Bloomberg, Mar 22, 2017. OPIC, fascinating example of a govt-run financing corporation.

Justin Glawe, Pro-Trumpcare Republicans Owned Millions in Health-Care Stock. The Daily Beast, May 24, 2017.

Tilman Achtich, Hanspeter Michel, and Deutsche Welle Documentary, How the Rich Get Richer - Money in the World Economy. Deutsche Welle Documentary, Jul 5, 2017. Spotlights the banking and finance industry offering cheap money at low interest rates impacts everything else. Corporate law and shell companies become the mechanism to leverage the credit and use dirty money. Money can act globally while the middle-class and labor cannot. This is why the real estate market becomes overpriced into asset bubbles: housing becomes part of the speculative market. Corporations take out cheap loans from banks to buy out other corporations, leading to monopoly power, without increasing wages. Private banks create money for themselves because they are required to park only a fraction of the money they lend out with a central bank. A policy change is to prevent private banks from creating new money through credit-debt cycles by strengthening the rules central banks impose on private banks. Other policy changes include debt-forgiveness, higher lending reserve requirements, a higher global tax on financial transactions, and incentivizing investments into socially and ecologically productive goals.

Stacy Cowley, 18 States Sue Betsy DeVos Over Student Loan Protections. New York Times, Jul 6, 2017. Regarding for-profit colleges and student loan trickery.

Craig Unger, Trump's Russian Laudromat. New Republic, Jul 13, 2017.

Nick Penzenstadler, Steve Reilly & John Kelly, USA TODAY is Tracking Trump's Real Estate Deals. You Can Help. CNBC, Aug 8, 2017.

David Dayen and Ryan Grim, There's a New Wells Fargo Scandal: This Time Its the Trucoat. The Intercept, Aug 12, 2017.

Chuck Collins, Loan Sharks Were Meant to Be Eradicated. Now They're Back. The Guardian, Aug 23, 2017. Not "mom and pop" landlords, but Wall Street private equity firms practicing private predatory mortgage lending where you don't build equity and don't own until your last payment.

Sandra Navidi, Superhubs: How the Financial Elite and their Networks Rule Our World. Nicholas Brealey | Amazon page, 2017. “The World Economic Forum in Davos, the meetings of the International Monetary Fund, think-tank gatherings and exclusive galas. This is the most vivid portrait to date of the global elite: the bank CEOs, fund managers, billionaire financiers and politicians who, through their interlocking relationships and collective influence are transforming our increasingly fragile financial system, economy and society.” See interview by New Economic Thinking, How Elite Financial Networks Rule the World. New Economic Thinking, Aug 30, 2017.

Aida Chavez, Bank Downgrades Chipotle, Complaining It Pays Workers Too Much. Chipotle Says That's Bunk. The Intercept, Oct 20, 2017. Bank of America is the bank in question.

Amy Goodman, Kept Out: Banks Across US Caught Systematically Rejecting People of Color for Home Loans. Democracy Now, Feb 15, 2018.

Aaron Glantz and Emmanuel Martinez, Kept Out: How Banks Block People of Color from Homeownership. Associated Press, Feb 15, 2018.

Zach Carter, A Dozen Democrats Want To Help Banks Hide Racial Discrimination In Mortgages. Huffington Post, Mar 1, 2018.

Elizabeth Warren, Banking's Racist Past. Reflect, Mar 13, 2018. A 10 minute speech on the Senate floor; see Emily Stewart, The Bank Deregulation Bill the Senate Just Passed. Reflect, Mar 14, 2018. See also Bartlett Taylor, Bank Lobbyist Act Update. Citizen Vox, Mar 28, 2018.

Michael Harriot, Doug Jones and the Democratic Party Just Screwed Black Voters. Again. The Root, Mar 15, 2018. And Ryan Cooper, The Subtle Racism of Centrist Democrats. The Week, Mar 9, 2018.

Peter Ford and Laurent Belsie, Disclosure in the Caymans: Global Walls of Financial Secrecy Are Falling. Christian Science Monitor, May 3, 2018.

Gillian B. White, America’s Whittling Away of Consumer Protections. The Atlantic, Jun 6, 2018.

Arielle Gray, I Couldn’t Afford To Pay My Student Loans. Then I Received A Warrant For My Arrest. Huffington Post, Jun 22, 2018. highlights many of the dangers of student loan arrangements

Tom Nichols, What Jonathan Chait Gets Right About Trump and Russia. Politico, Jul 10, 2018. Shows how financial and economic interests are ultimately national, not neutral or individual.

Racist American History, The Racist History of Banking. Splinter, Jul 11, 2018. How black Americans were systematically discriminated against through our financial system.

Michelle Conlin, Spiders, Sewage, and a Flurry of Fees — The Other Side of Renting a House from Wall Street. Reuters, Jul 27, 2018.

Craig Unger, House of Trump, House of Putin: The Untold Story of Donald Trump and the Russian Mafia. Dutton | Amazon page, Aug 14, 2018. See interview by Sean Illing, Trump's Ties to the Russian Mafia Go Back 3 Decades. Vox, Nov 19, 2018. Re: the Russian mafia being a state actor; money laundering; anonymous shell companies; debt as a political tool, not just an economic category; and American prosecution decades ago.

The Editorial Board, Inviting the Next Financial Crisis. New York Times, Aug 25, 2018.

Zach Carter, Why Does Wells Fargo Still Exist? Huffington Post, Aug 25, 2018. not just "too big to fail" but "too big to fix"

Alice Speri, It Took a Handful of Women to Kneecap One of the World's Most Brutal Crime Networks. The Intercept, Sep 9, 2018. Note the links between banking and organized crime in Italy's Ndragheta.

Zach Carter, Ten Years After The Financial Crisis, The Contagion Has Spread To Democracy Itself. Huffington Post, Sep 15, 2018. Tim Geithner, Ben Bernanke and Hank Paulson dealt a catastrophic blow to public faith in American institutions.

The Young Turks, Gary Cohn: What Laws Did I Break? The Young Turks, Sep 19, 2018. Financial fraud where banks sold to customers while betting against them, used derivatives to bet on home mortgages.

Ben Chapman, The Britain's Public Finances Worse Than Gambia, Uganda and Kenya, Because of Privatisation, IMF Finds. UK Independent, Oct 11, 2018. "Bank bailouts, rising pension liabilities and sell-off of public assets have wiped £1 trillion off UK’s net wealth, study suggests"

Aaron Ross Sorkin, Paul Volcker, at 91, Sees ‘a Hell of a Mess in Every Direction’. New York Times, Oct 23, 2018.

Peter Bildsen, I Respected Scott Walker. Then I Worked For Him. The Atlantic, Oct 25, 2018. From his former Secretary of Wisconsin Department of Financial Institutions, demonstrating how lobbyists and political ambition dampen the strength of healthy regulation.

Renae Merle, Wells Fargo Admits It Incorrectly Foreclosed on 545 Homeowners It Should Have Helped. Washington Post, Nov 6, 2018.

Maureen Dowd, Too Rich to Jail. New York Times, Nov 17, 2018.

Renae Merle, Banking Industry Profits Hit Another Record, $62 Billion. Washington Post, Nov 20, 2018.

Michael Stratford, Trump Administration Hid Report Revealing Wells Fargo Charged High Fees to Students. Politico, Dec 10, 2018.

Michael Hirsh, How Russian Money Helped Save Trump’s Business. Foreign Policy, Dec 21, 2018. "After his financial disasters two decades ago, no U.S. bank would touch him. Then foreign money began flowing in."

Emily Stewart, “I Have the Gavel”: Maxine Waters Lays Out an Aggressive Agenda at the House Financial Services Committee. Vox, Jan 16, 2019.

Rachel Maddow, Michael Cohen Documents Raise Questions About Donald Trump Financial Fraud. Rachel Maddow | MSNBC, Feb 28, 2019. Case study of real estate financial fraud; Trump applied to Deutschebank for a loan in 2012, and added a quarter billion dollars to his valuation of a property in Bedford, NY to inflate his assets to be eligible for a larger loan; raises a question about whether Deutschebank knew about this.

Franklin Foer, Russian-Style Kleptocracy Is Infiltrating America. The Atlantic, Mar 2019. “Washington had placed its faith in the new regime’s elites; it took them at their word when they professed their commitment to democratic capitalism. But Palmer had seen up close how the world’s growing interconnectedness—and global finance in particular—could be deployed for ill. During the Cold War, the KGB had developed an expert understanding of the banking byways of the West, and spymasters had become adept at dispensing cash to agents abroad.”

Bryan Tyler Cohen, Ocasio-Cortez Confronts [Bank] CEO's with Companies Illegal Acts to Their Faces. Bryan Tyler Cohen, Apr 12, 2019. Displays a long list of fines that banks paid because they were sued, in recent years.

Veronique de Rugy, Corporate Welfare Wins Again in Trump’s Washington. New York Times, May 7, 2019. “We don’t need the Export-Import Bank, which pads the profits of politically connected corporations on the taxpayer’s dime, but it’s back anyway.”

Emily Stewart, Why Banks Kept Doing Business With Jeffrey Epstein. Vox, Aug 13, 2019.

Peter J. Wallison, The Treasury’s Housing Plan Would Pave the Way for Another Financial Crisis. National Review, Sep 27, 2019. The privatization of Fannie Mae and Freddie Mac, housing mortgage guarantors, proposed by the Trump administration. This article is significant because it comes from a conservative position, admitting that the financial sector’s stability is dependent on law and regulation, if not public institutions outright.

Nick Wadhams, Saleha Mohsin, Stephanie Baker, and Jennifer Jacobs, Trump Urged Top Aide to Help Giuliani Client Facing DOJ Charges. Bloomberg, Oct 9, 2019. See helpful summary by Rachel Maddow, Trump Asked Rex Tillerson To Help Giuliani Client With DOJ: Bloomberg. The Rachel Maddow Show | MSNBC, Oct 9, 2019. Iranian-Turkish gold trader Reza Zarrab was money-laundering on behalf of Iran, to evade the economic sanctions against Iran. Notably, Reza Zarrab was previously represented by Giuliani. Zarrab implicated Turkish president Erdogan, who then pressured prosecutor SDNY Preet Bharara. who Trump fired); and suggests that Trump is implicitly or explicitly helping Turkish financiers evade Iranian sanctions, profiting billions. Recall short-lived Trump aide Mike Flynn was paid by Turkey while working for Trump as NSA Director. Recall that Trump tried to quash the Justice Department’s prosecution pressuring FBI Director James Comey to let Mike Flynn go. See also Brendan Pierson, Turkish Gold Trader Details Money Laundering Scheme for Iran. Reuters, Nov 29, 2017. See also Brendan Pierson, Turkish Gold Trader Implicates Erdogan in Iran Money Laundering. Reuters, Nov 30, 2017. See also Jonathan Schanzer, The Biggest Sanctions-Evasion Scheme in Recent History. The Atlantic, Jan 4, 2018. See also Benjamin Weiser, Turkish Banker in Iran Sanctions-Busting Case Sentenced to 32 Months. New York Times, May 16, 2018.

Atossa Araxia Abrahamian, The Comoros Connection. The Intercept, Oct 26, 2019. “How [Malaysian financier] Jho Low, Wanted For History’s Biggest Heist, Parked His Money at an Obscure, Kuwaiti-Owned Bank” in the Comoro Islands off the coast of India; yet another money laundering story

Farron Cousins, Payday Lenders Raise Money For Trump To Avoid Regulation. Ring of Fire, Oct 30, 2019.

David Doel, Alexandria Ocasio-Cortes Passionately Demolishes Private Equity Firms. The Rational National, Nov 20, 2019. Private equity firms leverage debt, buy companies, strip them of assets and jobs, and sell at a profit; they also contribute to political campaigns to advance/maintain lax financial laws.

Wall Street Journal, The $3.7 Trillion Corporate Debt Question. Wall Street Journal, Dec 5, 2019. About bond ratings and systemic risk to the economy.

David Enrich, Dark Towers: Deutsche Bank, Donald Trump, and an Epic Trail of Destruction. Custom House | Amazon page, Feb 2020. See reviews by Steven Pearlstein, The Fall of Deutsche Bank: Lies, Greed, Money Laundering and Donald Trump. Washington Post, Feb 14, 2020. See Robin Kaiser-Schatzlein, Deutsche Bank’s Perilous Pursuit of Profit. The New Republic, Feb 19, 2020. “From Nazi collaboration to money laundering, a new book chronicles the German bank’s “trail of destruction.””

Economics Explained, Money Laundering: A How To Guide For The Modern Global Billionaire. Economics Explained, May 7, 2020.

The Onion, Protestors Criticized For Looting Businesses Without Forming Private Equity Firm First. The Onion, May 28, 2020. Satirical but poignant truth.

Private Equity Eyes $400bn Windfall from US Retirement Savers. Invest, Jun 3, 2020.

Brooke Sweeney, Wall Street Is Making Millions Off Police Brutality. Vice, Jun 24, 2020. “So-called “police-brutality bonds” are a transfer of wealth from Main Street to Wall Street.”

Krystal Ball and Saagar Enjeti, David Sirota: Wall Street Just Got New Legal License to Gamble During Depression. Rising | The Hill, Jun 26, 2020. Weakening the Volcker Rule allows banks to invest in venture capital funds, and that banks can keep capital reserves at lower levels. See also Matt Stoller, The End of Private Equity Is Coming. Matt Stoller, Jul 3, 2020. “A change by Labor Secretary Eugene Scalia lets ordinary investors put their money into PE. Should they?”

Kevin M. Kruse, Why a Biden Administration Shouldn’t Turn the Page on the Trump Era. Vanity Fair, Jul 7, 2020. “The Obama–Biden administration wanted to move forward rather than hold Wall Street bankers and CIA torturers accountable. If elected, Biden should follow FDR’s playbook and expose his predecessor’s corruption and mismanagement instead.” FDR’s administration pursued bankers including J.P. Morgan. “The American people, who had looked up to bankers in the 1920s, now called them “banksters”—gangster-like figures up to no good. The hearings had crafted a narrative about who had wronged them, and how, and prepared the way for Congress to enact sweeping new laws to ensure it would never happen again. The Securities Act of 1933 and the Securities Exchange Act of 1934 led to the creation of the Securities Exchange Commission which regulated Wall Street from that point on. The Glass–Steagall Act, meanwhile, forced commercial banks out of risky investments and established the FDIC system which guaranteed deposits in case of bank failures.”

Saagar Enjeti, Revealed How Epstein Funded Sex Trafficking Ring with Wall Street Help. Rising | The Hill, Jul 8, 2020. Deutsche Bank’s knowing participation in Epstein’s sex trafficking.

Patrick Rucker, Trump Financial Regulator Quietly Shelved Discrimination Probes Into Bank of America and Other Lenders. ProPublica, Jul 13, 2020. “At least six investigations into discriminatory mortgage loan “redlining” have been halted or stalled — against staff recommendations — under the Trump administration’s Office of the Comptroller of the Currency.”

Krystal Ball and Saagar Enjeti, New Docu-Series Unveils Massive Financial Crimes At Center Of 2008 Crash. Rising | The Hill, Aug 2, 2020. “Filmmakers Patrick Lovell and Eric Vaughn discuss the importance of highlighting the financial crisis of 2008 in their Docuseries The Con”

Michael McDonald and Mark Chediak, Hedge Fund Collects $3 Billion in Bet on Wildfire Insurance Claims. Insurance Journal, Aug 24, 2020. Baupost Group, the hedge fund run by Seth Klarman, received more than $3 billion in July from its bet on insurance claims against PG&E Corp. connected to a series of deadly California wildfires, according to people with knowledge of the matter. The payout yielded Baupost’s biggest profit generator last month and represented a sizable markup from what the firm had anticipated, it told investors Thursday. The fund bought $6.8 billion of subrogation claims against PG&E, court documents show… In a subrogation claim, an insurer sells the right to sue to recoup damages suffered by policyholders. Insurers offer the claims at a discount to investors in return for the certainty of being paid upfront… PG&E entered bankruptcy in January 2019 facing massive liabilities from blazes blamed on its equipment that scorched Northern California in 2017 and 2018. The fires killed more than 100 people and destroyed tens of thousands of structures. The utility, insurers and claims holders including Baupost reached a deal last September that would bring the investors $11 billion in cash, an arrangement approved by a federal judge. A spokesman for fire victims at the time called the accord a blatant move by the utility and insurers “to help wealthy hedge funds and Wall Street.””

Jason Leopold, Anthony Cormier, John Templon, Tom Warren, Jeremy Singer-Vine, Scott Pham, Richard Holmes, Michael Sallah, Tanya Kozyreva, Emma Loop, and Azeen Ghoraysh, FinCEN Files. Buzzfeed News, Sep 2020. See especially How Deutsche Let Dirty Clients Run Rampant. Buzzfeed News, Sep 20, 2020. BBC, FinCEN Files: All You Need to Know About the Documents Leak. BBC, Sep 20, 2020. Leaked documents involving about $2tn of transactions have revealed how some of the world's biggest banks have allowed criminals to move dirty money around the world. See also Saagar Enjeti, Unraveling How Wall Street Banks COVERED For Jeffrey Epstein. Rising | The Hill, Sep 22, 2020. links between pedophilia and banks. See Matt Taibbi, Revenge of the Money Launderers. Taibbi Substack, Sep 25, 2020. “The "FinCen Files" story reveals: getting caught not only doesn’t stop the world's biggest banks from moving dirty money, it may encourage them.” See also Andrew Ross Sorkin, Lauren Hirsch, Ephrat Livni, and Michael J. de la Merced, New Questions About Leon Black’s Ties to Jeffrey Epstein. NY Times, Oct 12, 2020. See commentary by Saagar Enjeti, Wall Street Billionaire Caught Paying Epstein Millions After Visiting Private Island. Rising | The Hill, Oct 13, 2020.

Krystal Ball and Saagar Enjeti, Media Mum As MASSIVE Criminal Financial Enterprise At JPMorgan Chase Exposed. Rising | The Hill, Sep 30, 2020. JP Morgan fined $920 million for “spoofing” in a RICO conspiracy. But how much money did they make? An example that there are two justice systems, and this was just the cost of doing business for banks.

Tom Burgis, Kleptopia: How Dirty Money Is Conquering the World. Harper | Amazon page, Sep 2020. From the review: “In this real-life thriller packed with jaw-dropping revelations, award-winning investigative journalist Tom Burgis weaves together four stories that reveal a terrifying global web of corruption: the troublemaker from Basingstoke who stumbles on the secrets of a Swiss bank, the ex-Soviet billionaire constructing a private empire, the righteous Canadian lawyer with a mysterious client, and the Brooklyn crook protected by the CIA. Glimpses of this shadowy world have emerged over the years. In Kleptopia, Burgis connects the dots. He follows the dirty money that is flooding the global economy, emboldening dictators, and poisoning democracies. From the Kremlin to Beijing, Harare to Riyadh, Paris to the White House, the trail shows something even more sinister: the thieves are uniting. And the human cost will be great.” See interview with Stephanie Ruhle, ‘Why Is This President Paying More To Foreign Nations In Taxes Than He Is To The U.S.?’ MSNBC, Oct 1, 2020. Ruhle positions Trump’s tax returns and debt into the pattern of officials who seek high office as immunity from prosecution.

Joeri Schasfoort, Why Private Bank Money Creation is Dangerous. Money & Macro, Jan 27, 2021. Why asset bubbles and financial cycles have positive feedback loops, like in the U.S. financial crisis. Banks lend, and want collateral, which mean that they make asset bubbles and financial cycles worse. What is “rational” from the individual person and individual bank perspective damage the system. Banks create a positive feedback loop between asset markets and bank lending. During the upswing, the asset valuation increases. But during the downswing, we are all unfortunate because people spend less when they need to repay loans, and banks go bankrupt.

Mehdi Hasan, Uncovering the Real Victims of the GameStop Stock Squeeze. The Mehdi Hasan Show, Jan 29, 2021. Interviews Anand Ghiradaradas about the $20 billion loss by Wall Street hedge funds. Comments on reaction by billionaire Leon Cooperman, etc. See also a humorous take by Trevor Noah, Here’s How Wall Street Has Always Manipulated the Markets. The Daily Social Distancing Show, Feb 3, 2021. Krystal Ball and Saagar Enjeti, Professor Richard Wolff: GameStop Reveals The Core Rot Of US Financial System. Rising | The Hill, Feb 5, 2021. Wolff talks about corporate deception of the public, then the negative impact of financial concentration and leverage.

Joeri Schasfoort, Why Private Bank Money Creation is Dangerous. Money & Macro, Jan 27, 2021. “There are two elements to the financial cycle story: 1) The first is that of rising asset prices, primarily houses, but also stocks. 2) And the second is that of rising debt to GDP. Or increased bank lending. The biggest and most recent episode of a financial cycle happened in the United States and it started … right around 1996. In this year both the level of debt compared to the size of the economy (also known as credit to GDP) and inflation adjusted house prices started to pick up. And up and up they went. And as they went up… the people were happy, the sky seemed the limit. If you want to get rich, just buy a house. And the banks? They were more than willing to lend. After all, if a borrower could not repay the loan, he or she could sell the house. Since the price could only go up, the house sale would always yield enough money to repay the loan…. Now at the same time, it so happened that the economy was doing really well. Even a big stock market crash in 2001 could not stop the party. After that stock prices also started to pick up until….. in 2006 house prices started dropping. Then in 2007 stock prices followed, and in 2008 everything came crashing down and the world faced its biggest banking crisis in a hundred years. Currently banks are far better regulated and are less likely to have pumped up asset prices such as those of stocks like Tesla, and Nvidia, but also about crypto assets like Bitcoin and Ethereum.”

Joeri Schasfoort, Why Financial Globalization is Dangerous. Money & Macro, Feb 4, 2021. Financial globalization started in the late 1970s. It was profitable for investors, but investors cause enthusiasm-driven feedback loops, causing intensified boom-bust cycles for entire nations and institutions like housing asset bubbles.

Bloomberg Quicktake, The Double Life of Wirecard’s Fugitive Executive. Bloomberg Quicktake, Feb 2, 2021. A 13 minute video; a scandal in Germany highlights how financial fraud happens, when 2 billion disappeared from a bank, as did its COO Jan Marsalek.

Joeri Schasfoort, Why Financial Globalization is Dangerous. Money & Macro, Feb 4, 2021. International finance can increase local asset bubbles, for example, by investing in property in major cities. Global banks can also intensify debt potential and decreases. Also, exchange rates can act as a buffer but also runs into the positive feedback problem. But central banks of small countries tend to follow the U.S. Fed.

Lynn Parramore, Meet the "New Koch Brothers" – the Hedge Fund Activists Wrecking America’s Green New Deal. Institute for New Economic Thinking, Mar 4, 2021. “The playbook of today’s hedge fund activists looks like this: Buy a wad of shares of a company on the stock market. Then, line up the proxy votes of the managers of funds who have hedgies manage pieces of their portfolio. Next, send a letter to the CEO of a target company demanding that he or she get busy pumping up the stock price. Hedge funds with deep pockets will spend millions making this happen – remember, their money comes from rich people or institutional investors like pensions and mutual funds who are seeking high yields. Occasionally hedgies will use their own money – those whose “war chests” have come from previous raids.” Parramore lists a strong of hedge fund raiders: Carl Icahn at Apple; Nelson Peltz at GE; Dan Loeb at Intel.

Saagar Enjeti, Oren Cass: Reveals Truth Behind Wall Street's Claim That They Add Value to the Economy. Rising | The Hill, Apr 2, 2021. from junk bonds in the 1980s to hedge funds today

Krystal Ball, The Next Housing CRISIS Is Here And The Villains Are Exactly Who You'd Expect. Rising | The Hill, Apr 6, 2021. big capital; important stats on how hedge funds and pension funds are buying real estate. Refers to Alana Semuels, When Wall Street Is Your Landlord. The Atlantic, Feb 13, 2019. “With help from the federal government, institutional investors became major players in the rental market. They promised to return profits to their investors and convenience to their tenants. Investors are happy. Tenants are not.”

Ryan Grim and Jon Schwartz, The Bigger Short: Wall Street’s Cooked Books Fueled the Financial Crisis in 2008. It’s Happening Again.. The Intercept, Apr 20, 2021. See interview by Krystal Ball, Ryan Grim And Wall St Whistleblower Claim Banks Engaged In Systemic Fraud In Commercial Real Estate. Rising | The Hill, Apr 20, 2021. Lenders are overrepresenting the borrowers’ income, then passing on the bundled debt to other investors.

Krystal Ball, Miners Strike In Existential Battle With Private Equity Backed Coal Company. Rising | The Hill, Apr 26, 2021. Helpful contrast between the power of capital and power of labor.

Bloomberg Quicktake, How Prince Andrew Helped a Secretive Bank Woo Sketchy Clients. Bloomberg Quicktake, May 18, 2021. A 13 minute video; clients included known kleptocrats and money launderers

Krystal Ball and Saagar Enjeti, David Sirota: Inside Koch Network’s Bid To Become America’s Landlord. Rising | The Hill, May 30, 2021. Koch Industries has invested in residential real estate, and also in favor of removing the COVID pandemic eviction ban. See also Ryan Grim and Emily Jashinsky, David Sirota: Blackrock, Koch Robbing Future Homeowners. Rising | The Hill, Jun 11, 2021. Private equity with pension money ride low interest rates to buy single family houses.

Krystal Ball and Saagar Enjeti, David Dayen: Private Equity Hijacks Infrastructure Plan. Breaking Points, Jul 27, 2021.

Jane Mayer, The Big Money Behind the Big Lie. The New Yorker, Aug 2, 2021. “Donald Trump’s attacks on democracy are being promoted by rich and powerful conservative groups that are determined to win at all costs.”

PBS Frontline, Money, Power and Wall Street, Part 1. PBS Frontline, Aug 13, 2021. Spotlights the origin of credit default swaps, a form of derivative that was designed by JP Morgan to offset credit risk posed by their purchase of Exxon Mobile debt. Wall Street firms then innovated to use this derivative. Part 2. PBS Frontline, Aug 14, 2021. narrates the story of how the country’s leaders—Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and New York Federal Reserve President Timothy Geithner—struggled to respond to a financial crisis that caught them by surprise. Part 3. PBS Frontline, Aug 15, 2021. examines President Obama’s response and his favoring of Treasury Secretary Tim Geithner over Larry Summers. Part 4. PBS Frontline, Aug 16, 2021. details more Wall Street profit at the expense of public pensions and municipalities.

Saagar Enjeti, Chinese Heist of the Century Shows Why US Elites Are Fools. Breaking Points, Aug 31, 2021. Re: semiconductors and Wall Street enthusiasm for corporate profits alone.

Steve Liesman, Fed Chief Powell, Other Officials Owned Securities Central Bank Bought During COVID Pandemic. CNBC, Sep 17, 2021.

Saagar Enjeti, BlackRock, Goldman Caught In Chinese Pay To Play Scheme. Breaking Points, Oct 8, 2021. Demonstrates how Wall Street firms got more invested in Chinese business, despite the reciprocal influence of Wall Street on the U.S. government.

CNBC, How BlackRock Became The World's Largest Asset Manager. CNBC, Oct 13, 2021. A 14 minute video about one of the most influential companies in global finance. Ryan Grim, Kim Iversen, and Robby Soave, BlackRock Behemoth Surges As Almost 20% Of Households Lose All Of Their Savings During Pandemic. Rising | The Hill, Oct 16, 2021. Re: BlackRock managing $10 trillion, which is larger than every country but the US and China. Their investments in other companies’ corporate equity give them enormous industrial and political power. Senator Elizabeth Warren. D-MA) argues that they fall into the “too big to fail” bank category which requires that they abide by certain regulations. See also NBC News, Investment Companies Pricing Out Homebuyers. NBC News, Oct 6, 2021. Focused on Atlanta, GA.

Vice News, The Man Behind the World's Biggest Financial Fraud. Vice News, Oct 29, 2021. Jho Low, who used stolen money from a corrupt government regime to manufacture the 1MDB scandal. This is instructive because the larger the fraud, the more banks and financiers were likely to want to be part of it.

Krystal Ball and Saagar Enjeti, Wall Street CEO Resigns Over Epstein Lies, Coverup. Breaking Points with Krystal and Saagar, Nov 2, 2021. Re: Jes Staley of Barclay’s, demonstrating the nefarious connections that can happen in finance because of the lack of transparency and regulation

Yanis Varoufakis, Ann Pettifor, and Noam Chomsky, Visionary Realism: A Green Future Beyond Capitalism. Diem25, Nov 15, 2021. A 60 minute discussion responding to COP26 with very important institutional insights. They argue for the redistribution of power, such as on-shoring capital, labor power and international trade agreements, public control of utilities, the WTO and immoral patent rights, etc.

Casey Michel, American Kleptocracy: How the U.S. Created the World's Greatest Money Laundering Scheme in History. St. Martin’s Press | Amazon page, Nov 2021. See interview by Robby Soave and Ryan Grim, Author: How The US Built The World's Biggest Offshore Tax Haven For Criminals, Oligarchs, & Despots. Rising | The Hill, Nov 21, 2021.

Warren Buffett: Leverage Is The Biggest Danger To Investors. | BRK 2004【C:W.B Ep. 322】YAPSS, Nov 21, 2021.

Anne Applebaum, The Kleptocrats Next Door. The Atlantic, Dec 8, 2021. The loopholes in banking and real estate that allow foreign oligarchs to launder their money in the US and the West.

Gravel Institute, Why Credit Scores Are a Scam. Gravel Institute, Dec 9, 2021. Credit card companies plan to rake in profits from poor people who struggle to keep up their payments.

Branko Marcetic, When Debts Become Unpayable, They Should Be Forgiven. Jacobin Magazine, Dec 23, 2021. “For centuries, debt and indebtedness have had profoundly destabilizing effects on human societies. In the ancient world, rulers and their subjects had a solution: known as a debt jubilee, it involved a periodic, unconditional wiping out of debt. We need such a jubilee today.”

Joseph Brown, The Impact of Derivatives on Prices (Manipulation?). Heresy Financial, Jan 6, 2022. Explains what derivatives are (calls, puts, market maker). Explains how banks are not the typical market makers, and can distort or manipulate stock prices.

Saagar Enjeti, Exposing Wall Street Destruction of America’s Housing Market. Breaking Points, Jan 21, 2022.

Krystal Ball and Saagar Enjeti, BlackRock Exposed For Greenwashing Polluters As Dems Fail. Breaking Points, Jan 21, 2022.

Richard Wolff, Ask Prof Wolff: Credit Unions vs. Banks. Democracy At Work, Jan 26, 2022. Explains that credit unions share whatever profits it makes with depositors.

Michael Cowan, What China Just Did With Their Gold! Michael Cowan, Jan 30, 2022. At the 3.40 mark, Michael says that the banks are manipulating the prices of gold with future contracts and derivatives, so that they can buy more and more gold at lower prices. Especially China and Russia.

Julia Rock and David Sirota, Biden’s Ukraine Plans Face Wall Street Roadblock. The Daily Poster, Feb 24, 2022. An important expose of the lack of financial transparency.

Katharina Pistor, From Shock Therapy to Putin’s War. Project Syndicate, February 28, 2022. “Although Vladimir Putin alone is responsible for the war in Ukraine, it is worth remembering that prominent Westerners played a key role in shaping Russia's post-Soviet trajectory. They insisted that market reforms must take priority over political reforms, and we are still living with that choice.” By prioritizing capitalism to the benefit of our companies, and not democratic reform, we strengthened fossil fuel oligarchy, militarism, and authoritarianism. See also Krystal Ball, How Financiers Force Us To War and Destroy Our Security. Breaking Points, Mar 1, 2022. Banks and fossil fuel companies’ search for profit damages any other values: national security, economic resilience, community.

Maxwell Strachan, Crypto Exchanges Refuse to Freeze All Russian Accounts. Vice News, March 1, 2022. “Binance, the world's largest exchange, said "unilaterally" banning users "would fly in the face of the reason why crypto exists."

Krystal Ball and Saagar Enjeti, How Wall Street Is Protecting Russian Oligarchs. Breaking Points with Krystal and Saagar, Mar 2, 2022. Organized crime and the like have been using Wall Street and US banks to launder money. The Corporate Transparency Act fixed this in principle, but it has not been enforced. Now, the Russian oligarchs are hiding their wealth on Wall Street and in US real estate while we try to sanction them for the Russian invasion of Ukraine.

Welcome to Londongrad, Where Kleptocrats Wash Their Money Clean. Video by Jonathan Pie and Adam Westbrook. New York Times, Mar 10, 2022.

Stephanie Ruehl, How Giant Investment Bank Goldman Sachs Is Profiting On Ukraine War. 11th Hour | MSNBC, Mar 11, 2022. Through a legal loophole, Russian bonds are marketed in the West to U.S. hedge funds. See also Wikipedia, Goldman Sachs Controversies (Wikipedia page)

Matthew Cunningham-Cook, How Boris Johnson’s Party Shielded Russian Oligarchs’ Cash. The Daily Poster, Mar 11, 2022. “Known as the City of London, the UK’s financial industry has been a bastion of secrecy for decades — and a top destination for Russian assets. A recent report from Transparency International showed that more than 20 percent of the nearly $9 billion in total property value in the UK associated with potential money laundering is connected to the Kremlin.”

Krystal Ball and Saagar Enjeti, How Private Equity Reaps Billions From Decimating Workers. Breaking Points with Krystal and Saagar, Mar 12, 2022. James Li refers to Michael Blanding, Do Private Equity Buyouts Get a Bad Rap? Harvard Business School, Jan 13, 2020 who shows that corporations taken over by PE reduce wages by 2% compared to peer corporations; thus PE does as much value transfer as value creation. Emily Stewart, What Is Private Equity, and Why Is It Killing Everything You Love? Vox, Jan 6, 2020. “Private equity led to the closing of Toys R Us and cost 30,000 workers their jobs — and it’s hardly the only example of a deal gone wrong.” Also links to ProPublica.

Michael Hiltzik, Is It Better to Protect Banks or People During Crisis? Now We Have an Answer. Los Angeles Times, March 16, 2022.

Krystal Ball and Saagar Enjeti, Wall Street Bankers Caught Rigging Big Stock Sales. Breaking Points, Apr 3, 2022. Insider information leads to investment banks selling just before big block sales.

Matthew Cunningham-Cook, A Pension Official Blows The Whistle. The Lever, Apr 6, 2022. “A new era in the decade-long battle by retirees and whistleblowers to halt massive transfers of wealth out of retirement funds and into Wall Street firms could be at hand, thanks to the case of Katie Muth. Muth, a Democratic Pennsylvania state senator, is one of 15 trustees who oversees Pennsylvania’s largest public pension fund, the Pennsylvania Public School Employees’ Retirement System. Not long after her February 2021 appointment to the board, Muth began questioning the fund’s investments in areas like private equity, hedge funds, and real estate. Over the past 30 years, public pension funds have moved $1.4 trillion of retiree savings into such high-risk, high-fee “alternative investments,” enriching finance industry moguls like Stephen Schwarzman of the Blackstone Group and Robert Mercer of Renaissance Technologies while often shortchanging retired public employees and teachers… Pennsylvania’s $72.5 billion teacher pension fund would have $4 billion in additional money had it instead invested in low-cost index funds for the 10 years ending June 30, 2021.”

Frank Vogl, The Enablers: How the West Supports Kleptocrats and Corruption - Endangering Our Democracy. Rowman & Littlefield Publishers | Amazon page, Nov 2021. “Authoritarian regimes in many countries, and the men that lead them, depend on the international management of licit and illicit funds under their control. Frank Vogl shows that curbing their activities for their kleptocratic clients is critical to secure democracy, enhance national security, and ensure international financial stability.” See interview by Christine Amanpour, Anti-Corruption Expert: The West Is Enabling Autocracies. Amanpour and Company, Apr 14, 2022.

Selam Gebrekidan, Matt Apuzzo, Catherine Porter and Constant Méheut, Invade Haiti,Wall Street Urged.The U.S. Obliged. New York Times, May 20, 2022.

Matt Stoller, Explained: Massive TD Bank Fraud, Fake Accounts Uncovered. Breaking Points with Krystal and Saagar, May 14, 2022. TD repeated Wells Fargo’s strategy of opening false customer accounts. Stoller also examines the federal bank regulator, the Office of Controller of the Currency, who knew for years that banks were cheating customers and treated laws as suggestions. Stoller says memorably, “The American economy, American society, is based on the idea that most of our institutions are dedicated to cheating people, and that is no way to run a democracy.”

Joseph Brown, Why Is Big Money Still Buying Single Family Homes? Heresy Financial, Jun 12, 2022.

Joseph Brown, Do Not Underestimate the Coming Economic Crisis. Heresy Financial, Jul 2, 2022. Argues the Fed will commit to deflation because the dollar is linked to the U.S. military. Other countries welcome the military if they have purchasing power, but if they lose that purchasing power, they will see fewer advantages to hosting US military presence.

NBC News, How Private Equity Firms Are Increasing U.S. Rent Prices. NBC News, Jul 28, 2022. “Rental prices are increasing by more than 30% in major cities across the U.S. with the national monthly average for a one-bedroom costing $1,701.” A two bedroom apartment costs $2,048. Freddie Mac lends to private equity firms, which is a problem. So now, 1.6 million Americans rent from a private equity firm.

Krystal Ball and Kyle Kulinsky, Why Private Equity Is Evil And How To Destroy It | Krystal Kyle & Friends, Breaking Points, Jul 31, 2022.

Stoic Finance, Blackrock: The Company That Owns The World (And Its Getting Worse). Stoic Finance, Aug 6, 2022. Starting with the Financial Crisis of 2008 - 09 and then the COVID pandemic of 2020. Blackrock owns real estate, pharma, and media, with over $9 trillion. Combining State Street, Vanguard, and Blackrock, these three asset management firms manage $15 trillion, 70 percent of the US GDP. Presents the history of Larry Fink and Blackrock. Blackrock became the right hand of central banks in times of crisis by buying risky debts in uncertain times.

Stoic Finance, JP Morgan's CEO Is Plotting To Destroy America | This Is Evil… Stoic Finance, Aug 19, 2022. Max highlights how market makers can disseminate false information to their advantage.

Patrick Boyle, Dirty Money Capital of the World? Patrick Boyle, Oct 21, 2022. “Russian oligarchs have kept their money in London for twenty years, encouraged by British bankers' lawyers and politicians. Critics say that the 'London laundromat' cleans dirty money from kleptocrats all over the world. This video looks at where dirty money comes from, how money laundering works and why it took Russia's invasion of Ukraine to put this issue in the spotlight. From One Hyde Park to Bishops Avenue. Where is oligarch money kept in London?”

Daniel Boguslaw and Ken Klippenstein, The Fed Likes to Tout Its Independence, So Why Are Big Banks Lobbying It? The Intercept, Oct 26, 2022. “Unlike Trump, Biden vowed to “respect the Fed’s independence,” even as bank lobbyists continue to swarm it.”

Krystal Ball and Saagar Enjeti, Big Banks Caught Lobbying Fed in Secret Meetings. Breaking Points, Oct 28, 2022.

Krystal Ball and Saagar Enjeti, Sam Bankman-Fried Indictment: Everything You Need To Know. Breaking Points with Krystal Ball and Saagar Enjeti, Dec 13, 2022. One of the most extreme examples of debt-funded fraud. It’s worth exploring why debt can serve as a financial instrument in this way.

Financial Times, Fractured Markets: The Big Threats to the Financial System. Financial Times, Dec 19, 2022.

Krystal Ball, Watch: Senator Warren Destroys Wells Fargo, Calls for Break Up. Breaking Points, Dec 22, 2022. Despite being fined by the Fed, the SEC, and other agencies, Wells Fargo continues to do illegal things.

Ryan Grim, How Wall Street Destroyed Beloved Midwest Institution. Breaking Points, Feb 28, 2023. Brendan Ballou, Plunder: Private Equity’s Plan to Pillage America. Ryan Grim uses monopoly money to simulate an exchange of the process by which private equity firms make so much money through backhanded and deceptive financial transactions.

More Perfect Union, We Asked Trump Voters About The Ohio Rail Disaster. More Perfect Union, Feb 28, 2023. Very insightful, informed opinions in Ohio.

Ben Taub, How the Biggest Fraud in German History Unravelled. The New Yorker, Feb 27, 2023. “The tech company Wirecard was embraced by the German élite. But a reporter discovered that behind the façade of innovation were lies and links to Russian intelligence.”

Rebecca Burns, David Sirota, Julia Rock & Andrew Perez, SVB Chief Pressed Lawmakers To Weaken Bank Risk Regs. The Lever, Mar 10, 2023. Collapsed bank’s president Greg Becker told Congress “enhanced prudential standards” should be lifted “given the low risk profile of our activities.” See also video summary by David Hirota, SVB Lobbied Congress To WEAKEN Regulations Before Collapse. Breaking Points, Mar 11, 2023.

Krystal Ball and Saagar Enjeti, Disgusting Cronyism Behind Silicon Valley Bank Bailout. Breaking Points, Mar 16, 2023.

Spencer Snyder, How Banks Gouge Working People For Record Profits. Breaking Points, Mar 19, 2023. Banks advertise “free checking” but charge overdraft fees, which overly penalize poor people and people of color. TD North Bank makes a quarter of its profits through overdraft fees.

Stoic Finance, Blackstone's 2023 Collapse | Worst Housing Market Crash Ever Begins. Stoic Finance, Mar 19, 2023. Blackstone has not been able to pay its debts for months.

David Sirota and Julia Rock, A Smoking Gun in the Bank Crisis. The Lever, Mar 21, 2023. “It was July 2018, just after President Donald Trump signed a bill rolling back the Dodd–Frank Wall Street Reform and Consumer Protection Act, passed after the financial crisis to improve oversight of banks. At the time, the Financial Stability Oversight Council (FSOC), set up by Dodd-Frank to identify risks to the financial system, published a list of major mid-sized banks and their levels of deposits with no federal insurance. If these banks were to fail, the uninsured deposits would not be accessible to the depositors. One financial institution stood out for having far more uninsured deposits than all the others: Silicon Valley Bank, where more than 90 percent of the deposits were uninsured. In comparison, on average, the other mid-sized banks had 44 percent of their deposits uninsured. (Today, uninsured deposits constitute more than $8 trillion — about 40 percent — of all bank deposits.)”

More Perfect Union, We Found The Guy Behind The Biggest Bank Collapse Since 2008. The Class Room | More Perfect Union, Mar 28, 2023. CEO Greg Becker lured 67% of all tech startups to bank with Silicon Valley Bank, while persuading government regulators to loosen regulations on SVB.

Brendan Ballou, Private Equity Is Gutting America — and Getting Away With It. New York Times, Apr 28, 2023.

Joeri Schaasfort, The Rise & Fall of Europe's Most Scandalous Bank. Money & Macro, Apr 30, 2023. Credit Suisse.

Gretchen Morgensen, These Are the Plunderers: How Private Equity Runs—and Wrecks—America. Simon & Schuster | Amazon page, Apr 2023. See interview by Christiane Amanpour, Pulitzer Prize-Winning Journalist: Private Equity Runs – and Wrecks – America. Amanpour and Company, May 8, 2023.

Saagar Enjeti, JP Morgan Pays 290 Million In Epstein Settlement. Breaking Points, Jun 13 2023.

Joeri Schasfoort, How China Hides Trillions From America. Money & Macro, Jul 21, 2023.

PoliticsJoe, How Blackrock Line Their Pockets Through Your Misery. PoliticsJoe, Jul 27, 2023. The corporate form emerged as a legal device to enable colonial dispossession and possession. The East India Company.

Akela Lacy, Payday Lenders Gave Millions to Republican Group That Backed Supreme Court Suit to Annihilate CFPB. The Intercept, Aug 30, 2023. “The Republican Attorneys General Association fought to help a Supreme Court case against the Consumer Finance Protection Bureau.”

CNBC, How Wall Street Profits From Student Loans. CNBC, Aug 31, 2023. Like mortgage-backed securities, “Billions of dollars worth of student loans are packaged and sold as assets known as SLABS to some of the biggest investors in America. So what exactly are SLABS and how does it help Wall Street profit from student loans?”

Diana B. Henriques, Taming the Street: The Old Guard, the New Deal, and FDR’s Fight to Regulate American Capitalism. Random House | Amazon page, Sep 2023. See interview by Walter Isaacson, FDR’s Financial Market Reforms Are on the Ballot in 2024 – and Why It Matters. Amanpour and Company, Sep 19, 2023.

Financial Times, Citigroup and the 'Financial Supermarket' Experiment. Financial Times, Nov 27, 2023. The merger of Citigroup and Travelers was the first post-Depression merger between investment and commercial banking. It was a disaster.

Jeff Jacoby, The Wonderful Life of ‘It’s a Wonderful Life’. Boston Globe, Dec 24, 2023. “In Frank Capra’s beloved film, numerous characters, and even a house, get a second chance.” The film earned notable enemies who were pro-banking.

How Money Works, WTF Does Private Equity Actually Do? How Money Works, Jan 28, 2024. Focus on corporate buyouts.

Wendover Productions, How Private Equity Consumed America. Wendover Productions, May 7, 2024.

DW Documentary, Trump, Putin & Co. - Deutsche Bank’s Questionable Clientele. DW Documentary | Deutsche Welle, May 9, 2024. “Deutsche Bank managers driven by greed set it on the wrong track in the 2000s. For many years, the financial institution maintained close ties with Vladimir Putin. And involved itself in shady deals with the Russian autocrat. In the early 2000s, Deutsche Bank wanted to make it big in Moscow. For some employees, this was something to be achieved by any means necessary: bribing Putin’s officials, brothel visits for good customers, money laundering for the mafia. When it all came to light, this sent a shock wave through the bank: to this day, Deutsche Bank is still laboring under the burden of fines totaling billions. But the CEOs claimed total innocence. Just one of many scandals. Other questionable deals include loans to Donald Trump. The bank’s very special relationship with the US-American real estate tycoon began in the year 1998. Trump was one of Deutsche Bank’s best customers until shortly before his 2017 presidency. The credit institute loaned him huge sums - despite his track record for business bankruptcy and a dubious reputation as a defaulting debtor.”

Jacobin Magazine, How the US Privatized War. Jacobin, May 14, 2024. Spotlights Dutch Reformed Midwesterner Erik Prince and Blackwater, the US mercenary firm he founded. Now private equity firms fund mercenary groups and private contractors.

Helen Santoro, Arms Dealers Shoot Down Accountability. The Lever, May 21, 2024. “The country’s top weapons manufacturers rejected shareholder motions to expose their emissions policies and human rights practices.”

Deutsche Welle, Switzerland: A Haven for Russian Money? DW Documentary, May 27, 2024. A 42 minute video featuring Finaport and other Swiss financial corporations.

James Li, Private Equity Pillaging Small Business In The US. Breaking Points, Jun 16, 2024. This is a very detailed, personal explanation of how private equity used very immoral and illegal means to buy up child care, special ed, small businesses.

Old Money Luxury, The $10 Trillion Dollar Family That Runs The World: The Finks. Old Money Luxury, Aug 21, 2024. Larry Fink is CEO of BlackRock. Fink developed the practice of mortgage-backed securities while at First Boston. Fink started BlackRock as a division of Blackstone, initially. From 1994 - 99, BlackRock became independent. From 2008, BlackRock was favored by the government in the bailout. BlackRock has been a major investor in the defense industry: Lockheed-Martin, Raytheon, and Boeing.

Zachary Crockett, Money Laundering. The Economics of Everyday Things | Freakonomics Radio Network, Aug 19, 2024.

Aaron Bastai, The Liberal World Order is Over. Here’s Why | Aaron Bastani Meets Anne Applebaum. Norava Media, Sep 8, 2024. Applebaum talks about her book Autocracy Inc., and the liberal global financial system which enables autocrats and anti-liberal oligarchs and dictators.

How History Works, How British Merchants “Perfected” Money Laundering. How History Works, Sep 17, 2024.

More Perfect Union, Private Equity’s Ruthless Takeover Of The Last Affordable Housing In America. More Perfect Union, Sep 18, 2024. Mobile home parks. They raise rents ruthlessly on retired people with fixed incomes. Today, 12 private equity firms own 1200 mobile home parks in the U.S.

More Perfect Union, BlackRock: The Conspiracies You Don’t Know. More Perfect Union, Sep 19, 2024. Monopoly power if BlackRock owns enough of a whole industry.

How Money Works, Wall Street's Dangerous New Obsession With Farmland. How Money Works, Oct 16, 2024.

John Coates, Most Americans Aren’t Aware of How Concentrated the Financial Sector Has Gotten. Harvard Business School, Oct 22, 2024. Harvard professor Coates gives a generally sympathetic view of private equity, but still calls for financial transparency.

Andy Spears, $870 Million in Fraud: The Zelle Story. Advocate Andy, Dec 20, 2024. “America’s largest banks own Zelle. And they are not interested in putting in the resources (money) to stop fraud on the platform OR to help customers who have been defrauded. JPMorgan Chase, Bank of America, and Wells Fargo reimbursed just 38% of fraud claims on the Zelle platform, according to a July Senate report that looked at disputed unauthorized transactions. Now, these three bad acting big banks face a lawsuit from the Consumer Financial Protection Bureau (CFPB).”

Kyle Kulinski, How Private Equity Snakes Are Destroying America. The Kyle Kulinski Show | Secular Talk, Jan 2, 2024. Kyle comments on Robert Reich’s short video about private equity in housing, health care, etc.

Helen Santoro, Wall Street Is Jacking Up The Cost Of Your Doctor Visits. The Lever, Jan 22, 2025. A groundbreaking study finds doctors affiliated with hospitals and private equity firms are charging billions more annually than independent general practitioners.

Basel Musharbash, Did a Private Equity Fire Truck Roll-Up Worsen the L.A. Fires? BIG | Substack, Jan 25, 2025. During the LA fires, dozens of fire trucks sat in the boneyard, waiting for repairs the city couldn't afford. Why? A private equity roll-up made replacing and repairing those trucks much pricier. Economic consolidation of fire truck manufacturing and servicing caused a major snag in fighting the LA fires.

More Perfect Union, Trump Said He’d Close This Wall Street Loophole. Will They Let Him? More Perfect Union, Jan 29, 2025. Carried interest of 20% was originally what ship captains charged during the days of colonialism. Hedge fund managers started charging 20% for money management. Reagan in 1986 signed a tax code act allowing a “pass through entity” to avoid taxes by shifting it to the capital gains category rather than the income category. The documentary features the political history of presidential candidates and presidents who tried to change the carried interest loophole. Blackstone, led by Steven Schwarzman, becoming the largest private homeowner and a huge lobbyist, always won the political battle.

Ben Norton, Trump Helps BlackRock Buy Panama Canal Ports, to Weaken China & Strengthen Wall Street. Geopolitical Economy Report, Mar 5, 2025. Trump lied and said China controls the Panama Canal.

Sam Pollak, The Looting Of America’s Affordable Housing Fund. The Lever, Mar 5, 2025. “Private equity firms are diverting billions from a Great Depression-era mortgage program — and making huge profits.” Arguably evidence that we need a public option for banking, especially mortgage lending. Backstopping private lenders creates too many opportunities for those private lenders to exploit the system.

During the Great Depression, as the rate of foreclosures reached a thousand per day and millions of Americans were pushed out of their homes, Congress passed the 1932 Federal Home Loan Bank Act, which established a discount banking system to encourage financial institutions to initiate mortgage transactions, also known as originating mortgages.

With a balance sheet reaching $1.3 trillion, the Federal Home Loan Bank System is the country’s second-largest issuer of debt behind the Treasury Department. It originally comprised a dozen regional banks scattered across the country that provided cheap loans to local mortgage lenders. Those mortgage lenders would package the loans into low-interest mortgages for homebuyers who otherwise could not afford a mortgage. The regional banks are cooperatively owned by their member financial institutions, which purchase shares in the banks in order to borrow from them.

The Federal Home Loan Bank System is a government-sponsored enterprise with a housing mission similar to the companies Fannie Mae and Freddie Mac. But while Fannie Mae and Freddie Mac buy and sell mortgages from banks and credit unions, the Federal Home Loan Bank System’s main purpose is to provide liquidity to member institutions so that those institutions can provide mortgages.

Home loan bank membership was initially limited to savings and loans institutions, also known as “thrift banks,” as well as insurance companies, which sold mortgages at the time. But in the 1980s, as thrift banks saw widespread failure due to risky investment practices, the federal home loan banks began losing too many members to sustain themselves.

In response, Congress overhauled the system. Through the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, Congress invited commercial banks and credit unions to become members of the Federal Home Loan Bank System.

The legislation also loosened rules requiring members to pledge residential mortgages as collateral in case they couldn’t pay back their loans. Now, members are able to pledge a wider range of collateral, including commercial loans, mortgage-backed securities, and government securities. That change has clouded the oversight on how the loans are used, said Sharon Cornelissen, director of housing for the consumer advocacy nonprofit Consumer Federation of America.

The legislation also introduced the system’s affordable housing program, which requires each regional bank to allocate 10 percent of its net earnings each year to grant programs that fund affordable housing initiatives in each of the bank’s regions.

Membership in the Federal Home Loan Bank System subsequently swelled. There are now more than 6,500 members of 11 regional banks, with commercial banks comprising more than half of that number. The system is expected to have received $7.3 billion in public subsidies in 2024 alone, according to the nonpartisan Congressional Budget Office.

The banks’ activity now reflects little of their original mission, and instead have together become a “Frankenstein Institution” that serves private interests, said Jared Gaby-Biegel, a research associate for the United Food and Commercial Workers (UFCW) union.

Home loan banks have become a go-to source for banks looking for quick cash: The system became a backstop to save financial institutions from failing during the 2008 financial crisis while over three million homeowners filed for foreclosure. During the regional banking turmoil of March 2023, as banks invested in risky cryptocurrency ventures, the home loan banks of San Francisco and New York lent roughly $58 billion to four banks — Silicon Valley Bank, Silvergate Capital Corp., Signature Bank, and First Republic Bank — before all four of those banks folded.

While the system’s affordable housing program is one of the largest sources of grant funds for affordable housing in the U.S., allocating $8 billion for affordable housing development since the program’s founding, the amount the banks contribute to the program pales in comparison to how much the system pays in dividends to its members. In 2022, affordable housing program contributions were assessed at $355 million, while the system paid out $1.4 billion in dividends. By 2023, the system paid out a record $3.4 billion in dividends to its members.

Matt Sledge, Here’s How Much the Guests at Trump’s Crypto Summit Donated to His Inauguration. The Intercept, Mar 7, 2025. The list of invitees at the White House crypto summit illustrates the tight link between Trump and new cohort of political donors. “In total, Trump received at least $10 million donated by crypto interests to his campaign or super PACs supporting him, according to the tracking website Follow the Crypto.”

Emma Janssen, Banks Approve of Republicans Increasing Bank Fees. The American Prospect, Feb 17, 2025. A Biden-era CFPB rule limiting overdraft fees is under challenge, and lawmakers used bank lobbyists for their testimonials.

“As predicted, Republicans in Congress are going after a Consumer Financial Protection Bureau (CFPB) rule that protects consumers from predatory overdraft fees that can cost hundreds of dollars a year. Lawmakers introduced a Congressional Review Act (CRA) resolution of disapproval on Wednesday that, if passed and signed by the president, will reverse the rule and hand a win to banks.

Because CRA resolutions cannot by stopped by a filibuster, they represent some of the most likely legislative actions of the early Trump term.

The rule under challenge places a $5 cap on the overdraft fees that banks can charge their customers, a major decrease from the typical $35 fee. In the rulemaking process, the CFPB found that some banks scheme and scam to maximize overdraft fees, setting new rules without notifying customers or even engineering the order of transactions to generate more fees. Capping these fees will rein banks in, and according to the CFPB’s calculations, save Americans $5 billion a year.

The rule was finalized last December and was scheduled to become effective in October. Because of acting director Russ Vought’s unlawful order stalling all CFPB work, the effective date has been suspended. But if Congress passes the CRA resolution, the overdraft rule could not come back in any “substantially similar” form. So it matters if congressional Republicans decide to support allowing banks to impose additional junk fees worth billions of dollars.

What’s more, the two legislators spearheading the overturn, House Financial Services Committee Chairman French Hill (R-AR) and Senate Banking Committee Chairman Tim Scott (R-SC), are in the pocket of big banks themselves. Hill’s top funding contributor last year was Bank of New York Mellon, the 13th-largest bank in the country, while Scott’s was Goldman Sachs. Hill is himself the former CEO of a community bank in Arkansas. As The Lever reported, Scott has received more than $5.3 million in campaign funds from the financial services industry over his career.

It’s up to Republicans to decide whether they will follow Hill and Scott and reveal themselves as objectively pro–junk fee by passing the resolution.”

Ryan Grim and Pablo Manriquez, Senate Republicans Effectively Legalized Debanking. Drop Site News, Mar 5, 2025. The CFPB rule took years to implement due to Wall Street opposition.

Brittany Lewis and Zach Everson, Experts Question 'Suspicious' Trading Volume Before Trump Jr., Eric Trump Join Nasdaq Firm. Forbes, Mar 18, 2025.